Amid all the announcements today, it& #39;s easy to overlook that the OBR has updated its scenario on a no-deal Brexit. It exposes an undeniably hard reality for the Govt that claims that the UK would "prosper mightily" under no-deal next year.

(Short thread)

(Short thread)

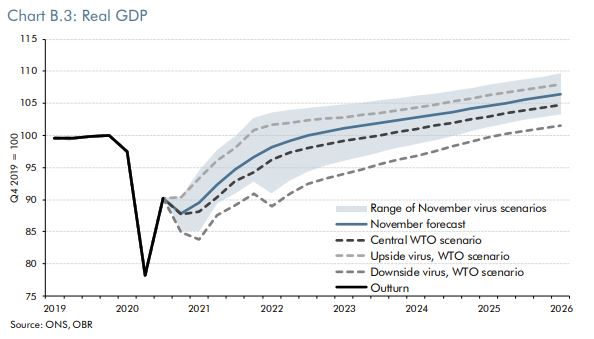

1. Key chart: a no-deal/WTO/Australia-style Brexit would delay the point at which econ output regains its pre-virus peak by "almost a year to the third quarter of 2023."

In the upside scenario, this cross-over point could be at the start of 2022; in the downside, in 2025. Grim.

In the upside scenario, this cross-over point could be at the start of 2022; in the downside, in 2025. Grim.

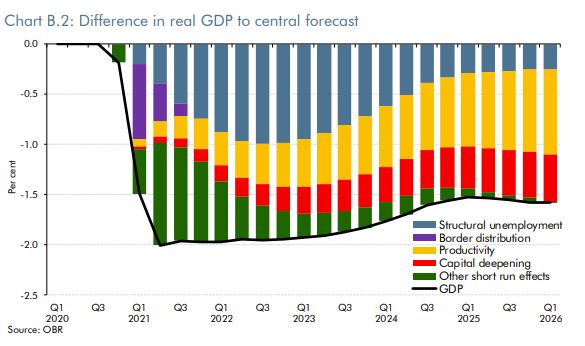

2. Next year, a no deal Brexit would reduce real GDP by around a further 2% - as a result of immediate disruption to the border and uncertainty facing businesses. That& #39;s on top of the Covid-related contraction.

3. While there& #39;s some short-term border disruption, most of the costs come in the medium term: from lost employment; productivity losses; lower business investment.

Exactly the opposite of what the Chancellor said to @AndrewMarr9 on Sunday. https://www.ft.com/content/716e14ed-8632-4678-a4d0-33b64eeb02cd">https://www.ft.com/content/7...

Exactly the opposite of what the Chancellor said to @AndrewMarr9 on Sunday. https://www.ft.com/content/716e14ed-8632-4678-a4d0-33b64eeb02cd">https://www.ft.com/content/7...

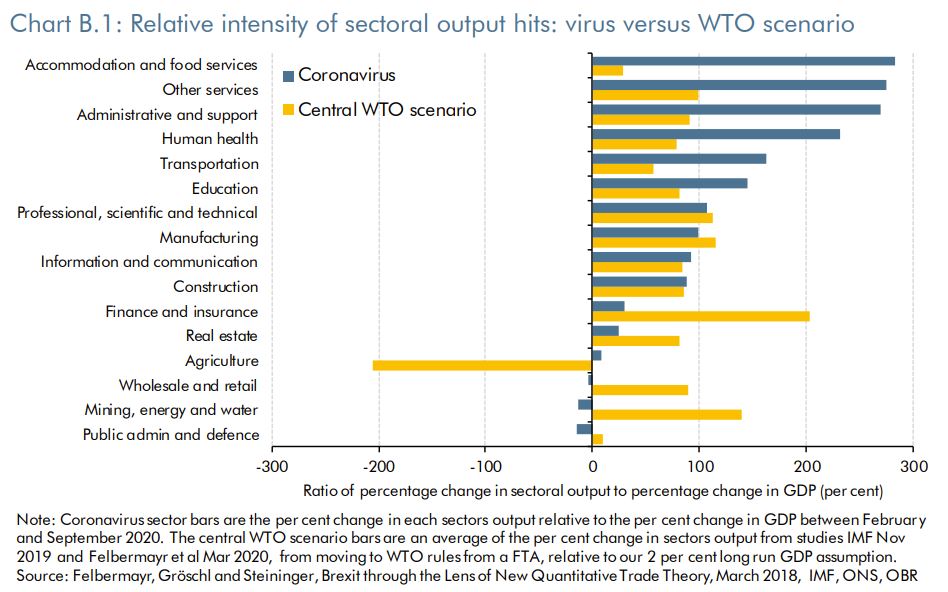

4. Underneath these numbers, output would fall *below* the Covid levels for several key sectors: Manufacturing, professional services, financial services, retail, energy.

All trade intensive sectors that have been spared the same drop in output as the non-tradables this year.

All trade intensive sectors that have been spared the same drop in output as the non-tradables this year.

5. Crucially, the OBR notes, no-deal would have additive effects to the hit by Covid, not replace it (contrary to the popular, but non-sensical narrative in Govt recently). It& #39;s a recipe for screwing the outward-facing side of the economy - which has been its engine during Covid

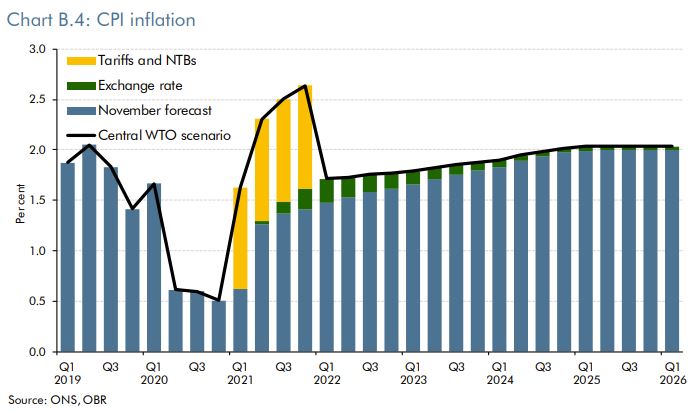

6. Under no-deal, the OBR also expect the inflation to rise by 1% next year - caused by new tariffs and regulatory and customs barriers with the EU.

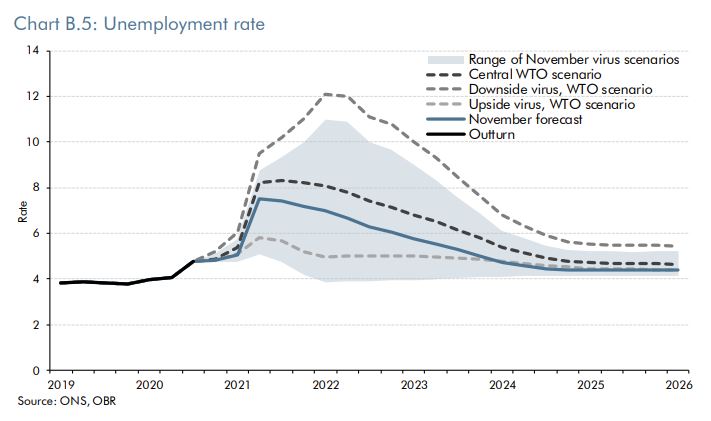

7. The unemployment numbers are also expected to rise up to 8.3% next year (under the central scenario).

8. By the way, these numbers assume that the lockdown ends on 2 Dec; the test-and-trace system is "partly effective" and the vaccination programme begins next year with "medium-high" success rate. A lot of big assumptions.

9. If there& #39;s one undeniable fact from the OBR figures, it& #39;s that the UK will not "prosper mightily" under no-deal, as the Prime Minister likes to claim.

It& #39;d be more than an act of self-harm to not agree a trade deal with the EU. It would be a full-blown economic suicide

(End)

It& #39;d be more than an act of self-harm to not agree a trade deal with the EU. It would be a full-blown economic suicide

(End)

Thank you for reading this far.

For a more complete picture of today’s Spending Review (beyond Brexit), do take a look at this comment by my colleagues @ianmulheirn and @JamesBrowneRTC: https://institute.global/policy/spending-review-2020-premature-cuts-now-tax-rises-follow">https://institute.global/policy/sp...

For a more complete picture of today’s Spending Review (beyond Brexit), do take a look at this comment by my colleagues @ianmulheirn and @JamesBrowneRTC: https://institute.global/policy/spending-review-2020-premature-cuts-now-tax-rises-follow">https://institute.global/policy/sp...

Read on Twitter

Read on Twitter