If you are married or in a civil partnership, and you or your partner earn less than £12500 and the other earns less than £50000 then you ca probably save some tax.

1/n

1/n

This government website will help you do it for free

https://www.tax.service.gov.uk/marriage-allowance-application/benefit-calculator/?_ga=2.158423546.1917508938.1605966188-1918818803.1602812558">https://www.tax.service.gov.uk/marriage-...

https://www.tax.service.gov.uk/marriage-allowance-application/benefit-calculator/?_ga=2.158423546.1917508938.1605966188-1918818803.1602812558">https://www.tax.service.gov.uk/marriage-...

This (free) guide from @litrgnews explains how marriage allowance, and other allowances, work https://www.litrg.org.uk/tax-guides/tax-basics/what-tax-allowances-am-i-entitled">https://www.litrg.org.uk/tax-guide...

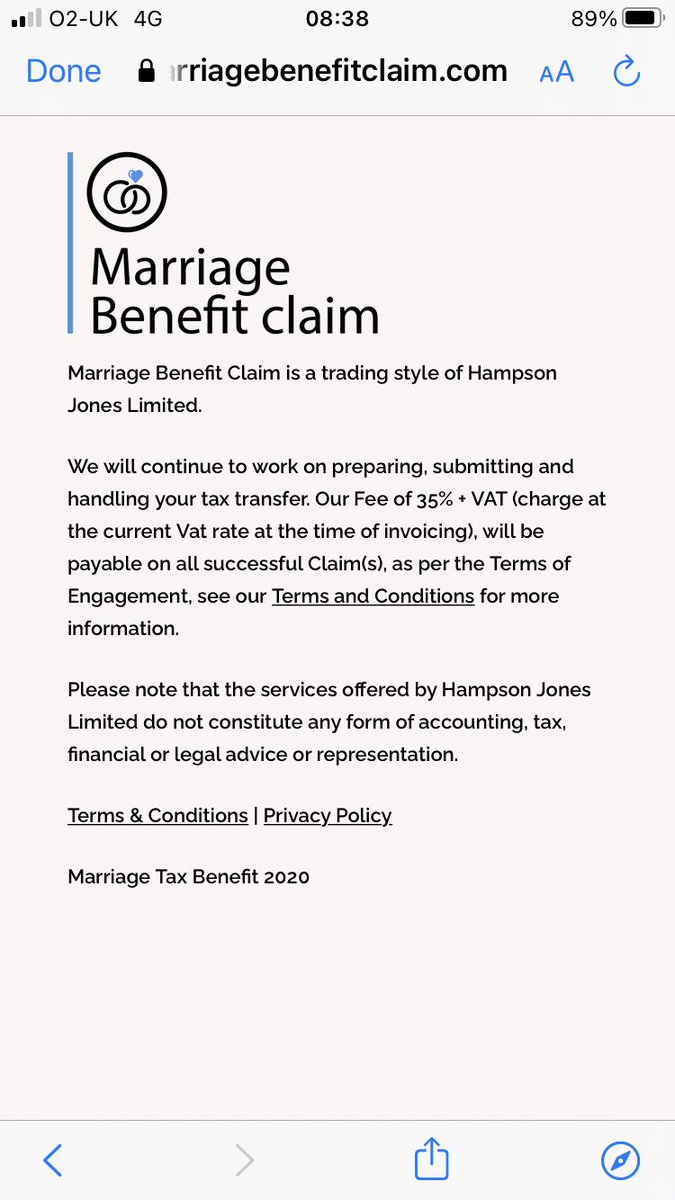

The marriage allowance is worth up to £250, if you qualify. If you use a commercial service, such as this one, they will charge you a fee to claim it.

I’ve posted these tweets because I am concerned that people, often on low incomes, are paying several hundred pounds for something they could do themselves, or with a little help, for free.

Use these services if you want, but be aware of cost

@paullewismoney @MartinSLewis FYI

Use these services if you want, but be aware of cost

@paullewismoney @MartinSLewis FYI

PS See recent press release from @litrgnews on this topic (h/t @victodd ) https://www.litrg.org.uk/latest-news/news/201113-press-release-hmrc-must-help-taxpayers-help-themselves-say-tax-campaigners">https://www.litrg.org.uk/latest-ne...

Read on Twitter

Read on Twitter