False analogy.

Asian pegs collapsed back in 1997 because external short-term fx debts exceeded reserves, not because of high m2 to reserves.

I (literally) wrote a book about it

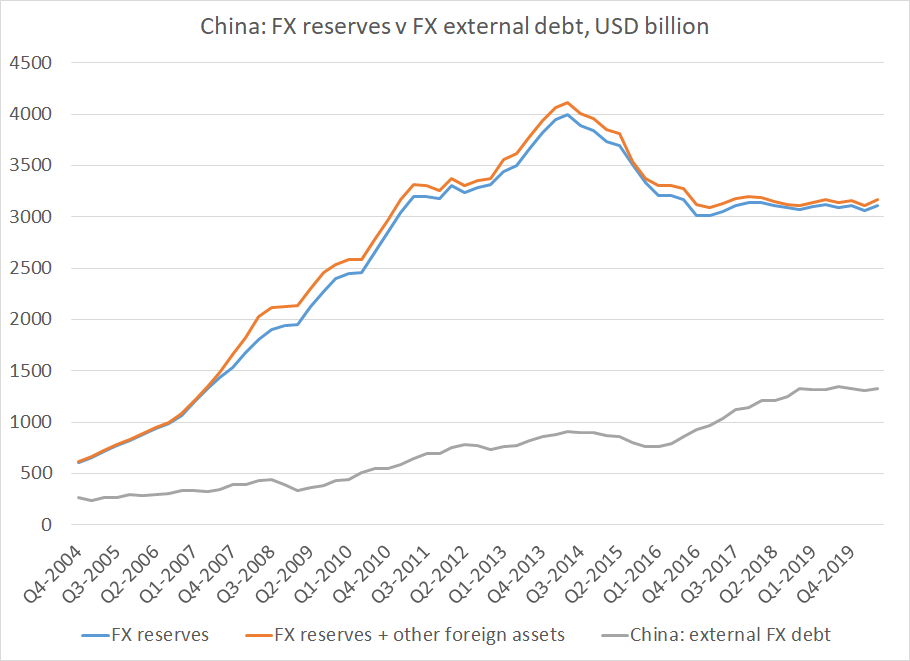

Chinese fx reserves still far exceed its external debt, let alone its short-term external debt https://twitter.com/mnicoletos/status/1318623464845045760">https://twitter.com/mnicoleto...

Asian pegs collapsed back in 1997 because external short-term fx debts exceeded reserves, not because of high m2 to reserves.

I (literally) wrote a book about it

Chinese fx reserves still far exceed its external debt, let alone its short-term external debt https://twitter.com/mnicoletos/status/1318623464845045760">https://twitter.com/mnicoleto...

China still has far more more visible fx reserves than it has fx denominated external debt (let alone short-term external debt), and the smart money (I hope) knows that China has some hidden non-reserve assets too

A high M2 ratio is correlated with a big domestic banking system with lots domestic deposits -- a strength, not a weakness as far as I am concerned.

It also tends to correlate with current account surpluses not deficits

(and China still has controls too ... )

It also tends to correlate with current account surpluses not deficits

(and China still has controls too ... )

Everyone has their obsessions.

The right (and wrong) way to measure China& #39;s reserve adequacy is one of mine.

Reserves to M2 is wrong for China, and most of the world.

This is a hill I will die on ... https://www.cfr.org/blog/dangerous-myth-china-needs-27-trillion-reserves">https://www.cfr.org/blog/dang...

The right (and wrong) way to measure China& #39;s reserve adequacy is one of mine.

Reserves to M2 is wrong for China, and most of the world.

This is a hill I will die on ... https://www.cfr.org/blog/dangerous-myth-china-needs-27-trillion-reserves">https://www.cfr.org/blog/dang...

Read on Twitter

Read on Twitter