Yalla is a voice-centric social network for the MENA region that IPO& #39;d this week at a $1.3b valuation

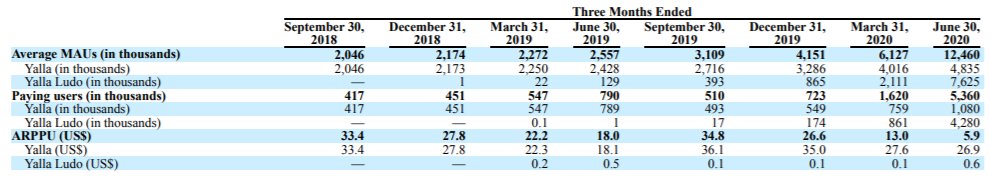

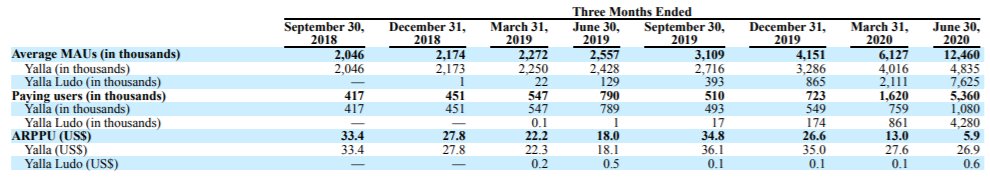

Their two apps had a combined 12.5m MAUs in Q2 & #39;20 using them 4.5 & 2.5 hours per day. It did $53m in revenue thru June 2020 on operating margins of 48%

http://app.quotemedia.com/data/downloadFiling?webmasterId=101533&ref=115247401&type=PDF&symbol=YALA">https://app.quotemedia.com/data/down...

Their two apps had a combined 12.5m MAUs in Q2 & #39;20 using them 4.5 & 2.5 hours per day. It did $53m in revenue thru June 2020 on operating margins of 48%

http://app.quotemedia.com/data/downloadFiling?webmasterId=101533&ref=115247401&type=PDF&symbol=YALA">https://app.quotemedia.com/data/down...

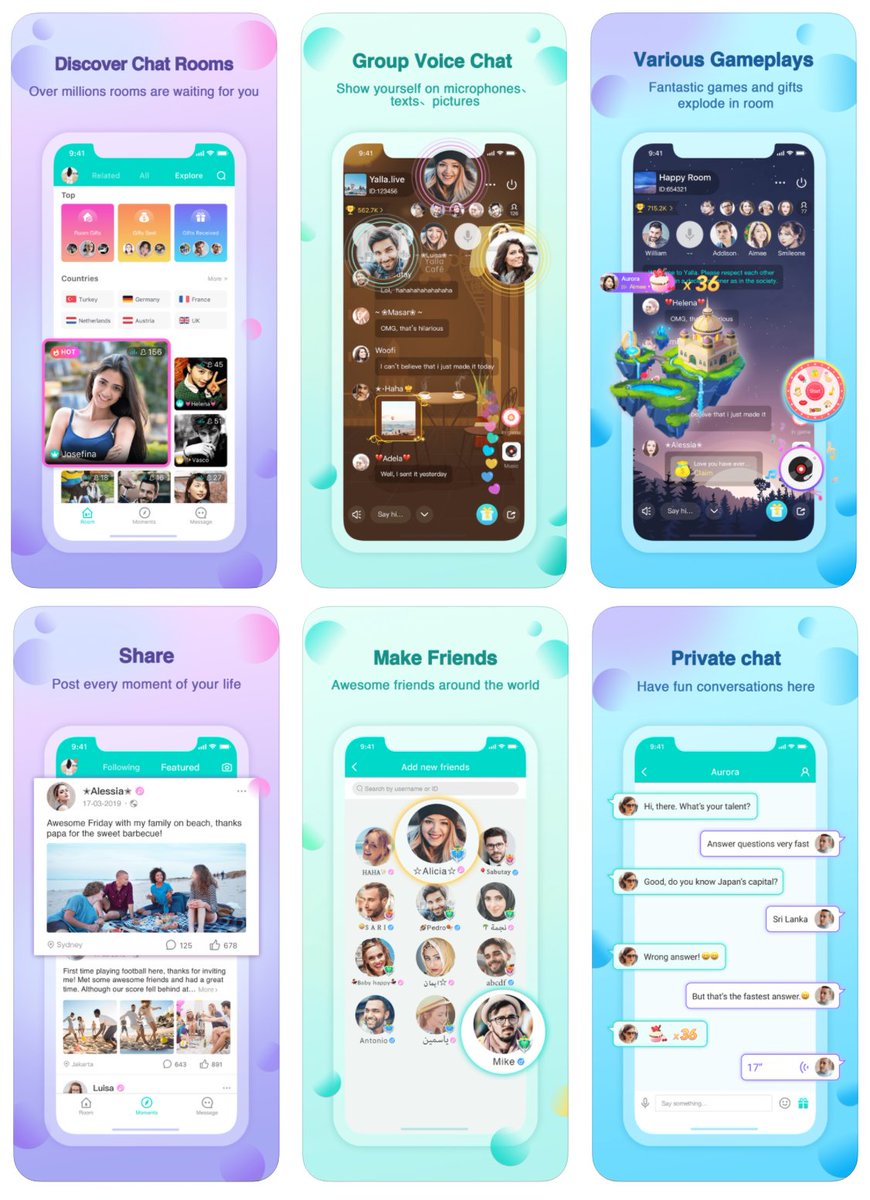

The initial app Yalla has a UI that& #39;s voice-first and revolves around voice group chats. Its described as "bringing offline user behaviors online".

It includes things like photo uploads, a friend feed, online / offline events and messaging. This likely increases the stickiness.

It includes things like photo uploads, a friend feed, online / offline events and messaging. This likely increases the stickiness.

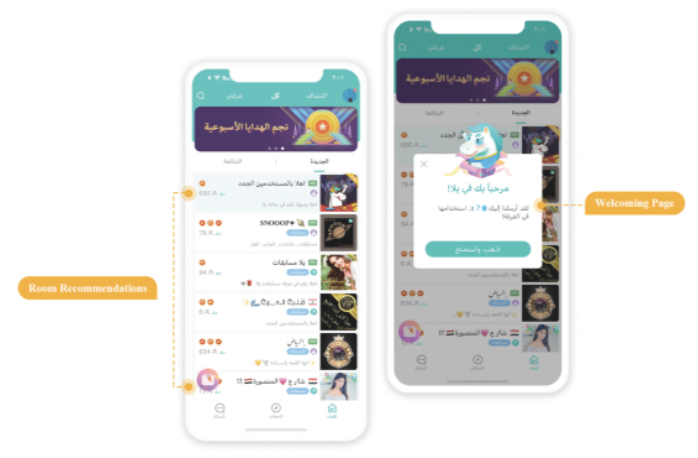

In their F-1 filing, they put lot of emphasis on the initial on-boarding. They recommend rooms on the first-open, and then it gathers their interests based on usage and slowly improves those recommendations over time.

Here& #39;s how Yalla thinks about their whole ecosystem:

It& #39;s clear that despite the initial voice-first chat product, its vision is an all-encompassing social media, messaging, and entertainment ecosystem. And it has 48% operating margins on only $63m of revenue through Q2 of 2020.

It& #39;s clear that despite the initial voice-first chat product, its vision is an all-encompassing social media, messaging, and entertainment ecosystem. And it has 48% operating margins on only $63m of revenue through Q2 of 2020.

Yalla is majority owned by Chinese founders who were formerly ZTE Dubai executives. I& #39;d assume ongoing geopolitical risks here. Big early investors appear to be SIG (ByteDance, Citrip) and Orchid Asia.

It has 274 employees, leveraging low cost labor in China for R&D + marketing.

It has 274 employees, leveraging low cost labor in China for R&D + marketing.

Yalla monetizes via virtual in-app upgrades, VIP treatment in rooms, and sending gifts (there& #39;s a leaderboard for who has given and received the most)

Its working: Before seeing explosive growth in free users during COVID, ARPU was $12/mo - similar to FB& #39;s monetization in the US

Its working: Before seeing explosive growth in free users during COVID, ARPU was $12/mo - similar to FB& #39;s monetization in the US

Its second product, Yalla Ludo, saw even faster growth during COVID - almost 10x& #39;ing MAU& #39;s from 865k to 7.6m by June 2020. 407m games were played in Q2.

It& #39;s still early, but despite the higher engagement, monetization on Ludo significantly lags its other voice-centric product.

It& #39;s still early, but despite the higher engagement, monetization on Ludo significantly lags its other voice-centric product.

What I& #39;m most concerned about is usage and long-term stickiness.

The filing mentions how active MENA social users are - but has no mention of Yalla& #39;s DAU& #39;s. It also mentions 68.6m registered users. With 12.5m MAU& #39;s in Q2 2020, its ~18% long-term retention has room to improve.

The filing mentions how active MENA social users are - but has no mention of Yalla& #39;s DAU& #39;s. It also mentions 68.6m registered users. With 12.5m MAU& #39;s in Q2 2020, its ~18% long-term retention has room to improve.

Another concerning disclosure was highlighting usage stats over a six-month period (not just Q2 like everything else in the filing). To me, it indicates a decline in usage post-quarantine.

Not to mention... perfect time to go public if you don& #39;t want to report your Q3 metrics https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht">

Not to mention... perfect time to go public if you don& #39;t want to report your Q3 metrics

Still - despite likely slowing, Yalla put up 48% operating margins on $53m in revenue through Q2 (up 99% YoY)

At a $1.3b valuation, the public market is valuing Yalla at $104 per MAU. Assuming DAU/MAU is roughly 30%, that ballparks it at $347 per DAU and 20.5x its 2019 revenue.

At a $1.3b valuation, the public market is valuing Yalla at $104 per MAU. Assuming DAU/MAU is roughly 30%, that ballparks it at $347 per DAU and 20.5x its 2019 revenue.

Read on Twitter

Read on Twitter

" title="Another concerning disclosure was highlighting usage stats over a six-month period (not just Q2 like everything else in the filing). To me, it indicates a decline in usage post-quarantine.Not to mention... perfect time to go public if you don& #39;t want to report your Q3 metrics https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht">" class="img-responsive" style="max-width:100%;"/>

" title="Another concerning disclosure was highlighting usage stats over a six-month period (not just Q2 like everything else in the filing). To me, it indicates a decline in usage post-quarantine.Not to mention... perfect time to go public if you don& #39;t want to report your Q3 metrics https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht">" class="img-responsive" style="max-width:100%;"/>