1/ Announcing something NEW @ Lux.

We are committing very big money

to a very big opportunity ahead.

(Led by my brilliant partner + cofounder @peterjhebert)

Here& #39;s what + here& #39;s why https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

We are committing very big money

to a very big opportunity ahead.

(Led by my brilliant partner + cofounder @peterjhebert)

Here& #39;s what + here& #39;s why

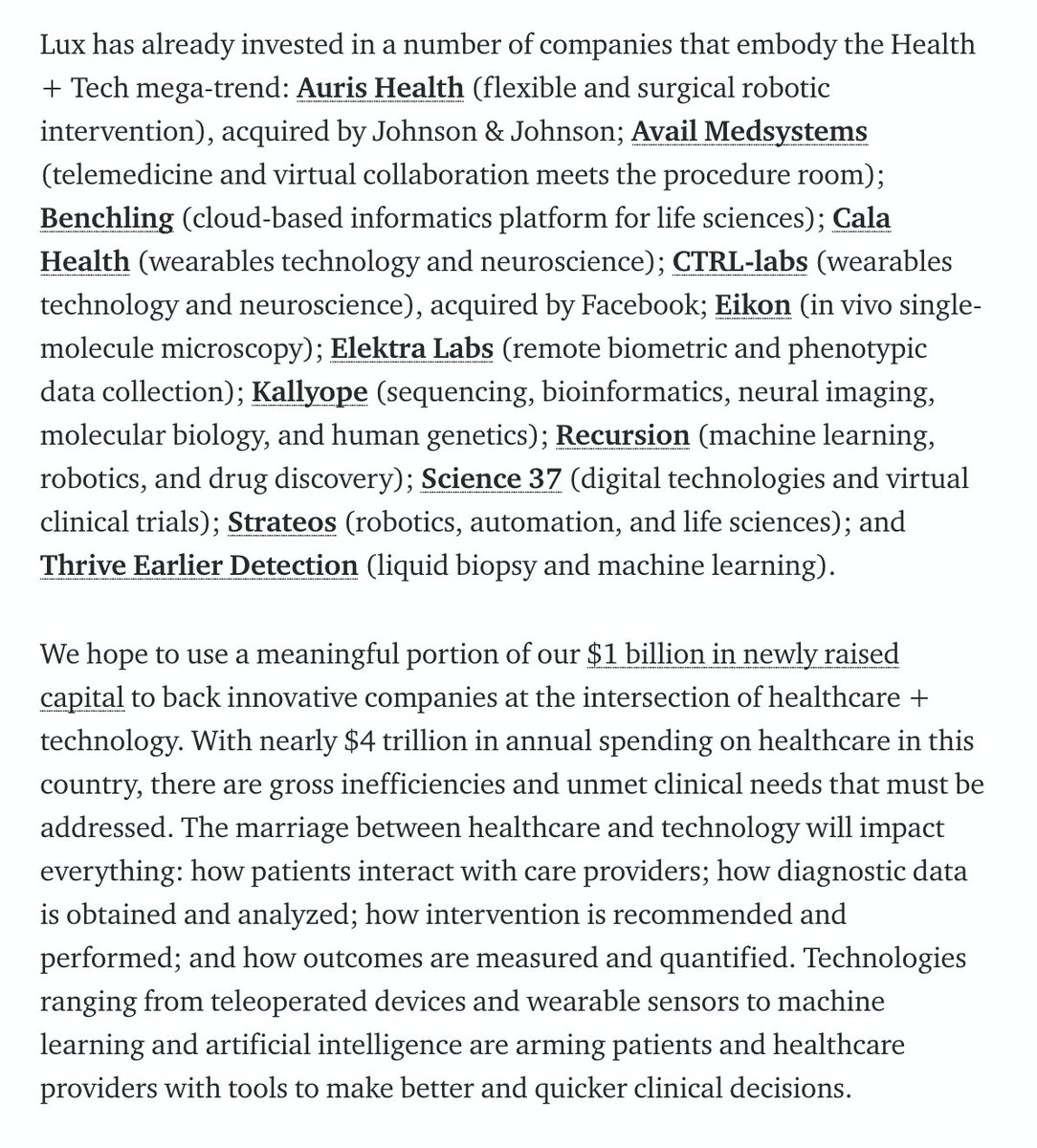

2/ We will be investing a BIG part of $1B of newly raised capital at the intersection of a HEALTH + TECH megatrend.

Forget buzzwords of "AI & machine learning, robotics + automation + machine vision"

––they only matter if they enable attractive high-growth business models...

Forget buzzwords of "AI & machine learning, robotics + automation + machine vision"

––they only matter if they enable attractive high-growth business models...

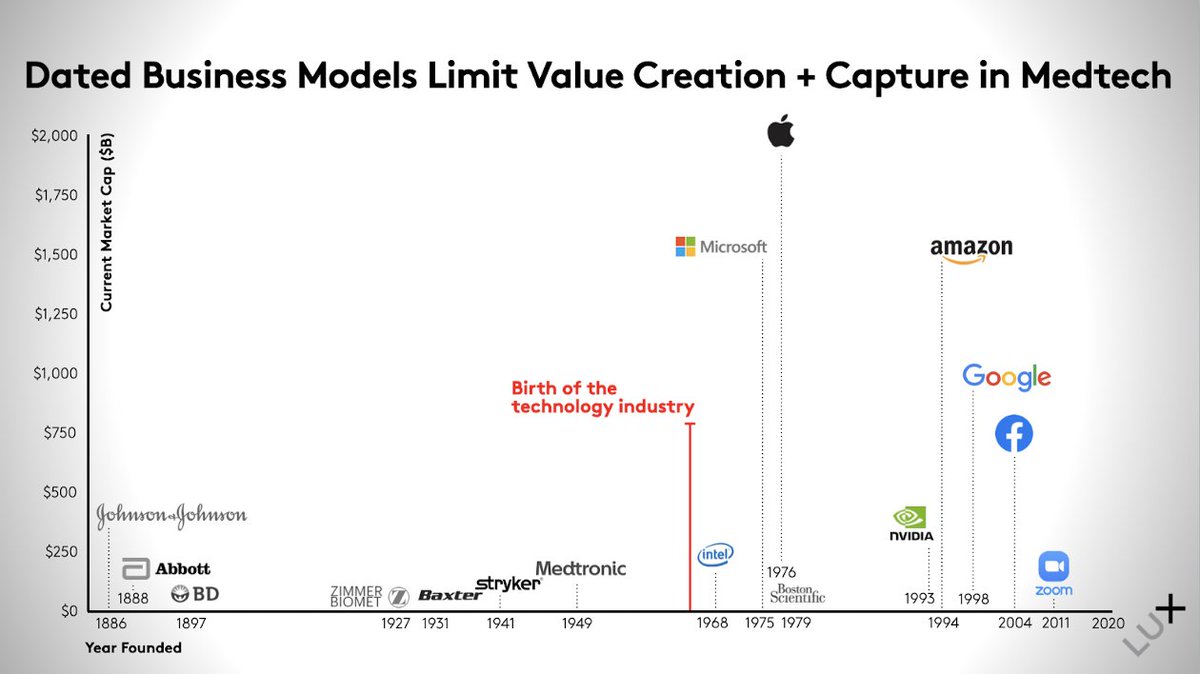

3/ Here& #39;s WHY––

Today& #39; medtech industry hasn& #39;t kept pace with the rate of innovation + value creation of TECH companies

VC-backed medtech has produced only a HANDFUL of innovative companies with large cap valuations since the turn of this century...

Today& #39; medtech industry hasn& #39;t kept pace with the rate of innovation + value creation of TECH companies

VC-backed medtech has produced only a HANDFUL of innovative companies with large cap valuations since the turn of this century...

4/ There are incredible success stories — Insulet, Livongo, 10x Genomics, NovoCure, Guardant, Penumbra, and iRhythm, to name a few —

but only ONE of the companies sits above $15 billion in market value....

but only ONE of the companies sits above $15 billion in market value....

5/ To find larger success stories we have to look back to Intuitive Surgical (now $81 billion in market cap), which was founded in... 1995!

Another huge success founded by Lux& #39;s late partner Larry Bock––last century––Illumina–– in 1998 is now over $45 billion in value. BUT...

Another huge success founded by Lux& #39;s late partner Larry Bock––last century––Illumina–– in 1998 is now over $45 billion in value. BUT...

6/ Beyond that––slim pickings.

In CONTRAST over the same time TECH created trillions of dollars in shareholder wealth from a blank canvas, propelling once humble start-ups to the upper echelon of the S&P 500: AMZN, FB, GOOG, Salesforce, Paypal, Netflix, Broadcom, ServiceNow…

In CONTRAST over the same time TECH created trillions of dollars in shareholder wealth from a blank canvas, propelling once humble start-ups to the upper echelon of the S&P 500: AMZN, FB, GOOG, Salesforce, Paypal, Netflix, Broadcom, ServiceNow…

7/ The list of multi-billion public TECH founded since 1995 is in the hundreds

So too biotech––from 1976 creation of Genentech (+ Amgen in 1980) scores of public co& #39;s valued in billions — Gilead, Vertex, Biogen, Regeneron, Alexion, Incyte, BioMarin, Moderna...

Medtech? BUBKIS.

So too biotech––from 1976 creation of Genentech (+ Amgen in 1980) scores of public co& #39;s valued in billions — Gilead, Vertex, Biogen, Regeneron, Alexion, Incyte, BioMarin, Moderna...

Medtech? BUBKIS.

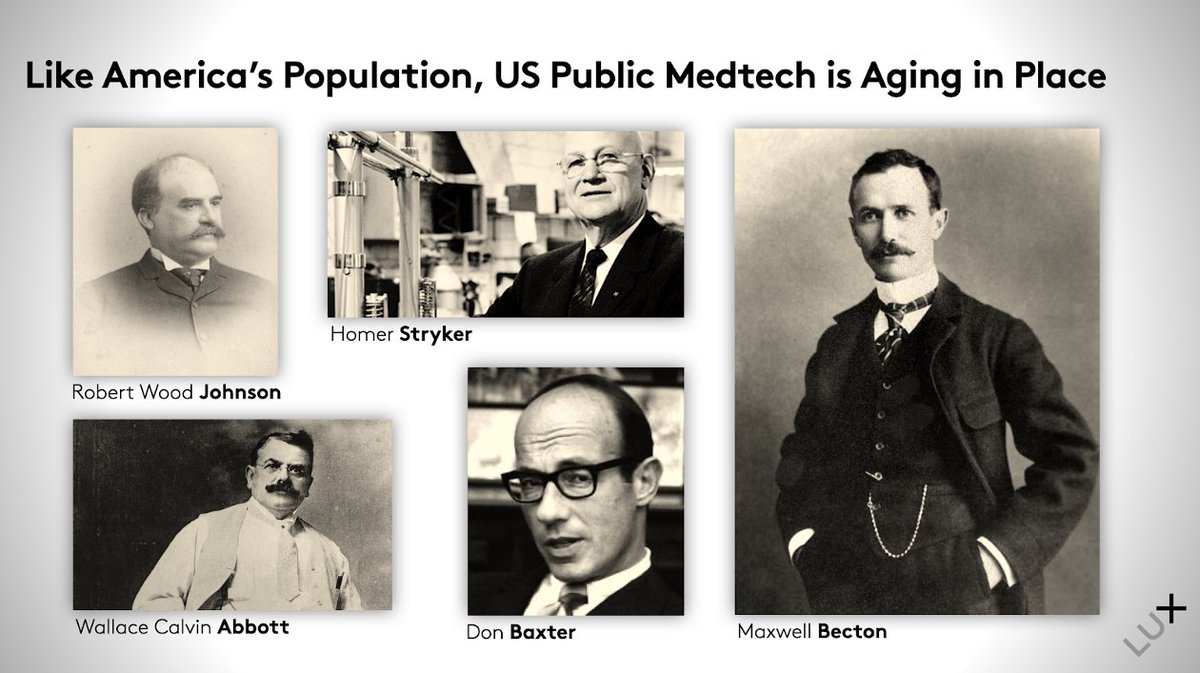

8/ Current crop of public US medtech — Abbott , Baxter , Becton Dickinson, Boston Scientific, J&J, Medtronic, Stryker, Zimmer — have an average founding date of... 1924.

Their age creates one significant disadvantage––REALLY dated business models.

Their age creates one significant disadvantage––REALLY dated business models.

9/ WHY?

medtech VC for too long saw success in tuck-in M&A fetching relatively low price tags in the low-to-mid hundreds of millions.

The result? Low ambitions + consolidation in the industry around a few REALLY old centenarian incumbents.

medtech VC for too long saw success in tuck-in M&A fetching relatively low price tags in the low-to-mid hundreds of millions.

The result? Low ambitions + consolidation in the industry around a few REALLY old centenarian incumbents.

10/ We& #39;ve over the past few months been quietly assembling + partnering with some INCREDIBLE savvy scientific entrepreneurs.

And many plans are NOT yet announced...BUT...

And many plans are NOT yet announced...BUT...

11/

TODAY we announce the start of a new initiative, which we intend catalyzes + ultimately leads to––

a NEW generation of standalone medical technology companies developing high-impact, high-growth, and high-value platform innovation:

Lux Health + Tech.

Stay tuned... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

TODAY we announce the start of a new initiative, which we intend catalyzes + ultimately leads to––

a NEW generation of standalone medical technology companies developing high-impact, high-growth, and high-value platform innovation:

Lux Health + Tech.

Stay tuned...

12/ Full post here https://medium.com/lux-capital/welcoming-a-new-secular-investment-wave-health-tech-450b6cf58a0e">https://medium.com/lux-capit...

Read on Twitter

Read on Twitter https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" title="1/ Announcing something NEW @ Lux. We are committing very big moneyto a very big opportunity ahead.(Led by my brilliant partner + cofounder @peterjhebert)Here& #39;s what + here& #39;s whyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" title="1/ Announcing something NEW @ Lux. We are committing very big moneyto a very big opportunity ahead.(Led by my brilliant partner + cofounder @peterjhebert)Here& #39;s what + here& #39;s whyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="11/ TODAY we announce the start of a new initiative, which we intend catalyzes + ultimately leads to––a NEW generation of standalone medical technology companies developing high-impact, high-growth, and high-value platform innovation: Lux Health + Tech.Stay tuned...https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">" class="img-responsive" style="max-width:100%;"/>

" title="11/ TODAY we announce the start of a new initiative, which we intend catalyzes + ultimately leads to––a NEW generation of standalone medical technology companies developing high-impact, high-growth, and high-value platform innovation: Lux Health + Tech.Stay tuned...https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">" class="img-responsive" style="max-width:100%;"/>