Quick thread on the importance of knowing index methodology (yes, you might even need to understand academic literature when selecting indices!):

1/ I am going to look at a similar index (large cap growth) from two major index providers S&P and Russell and their differences and what that might imply.

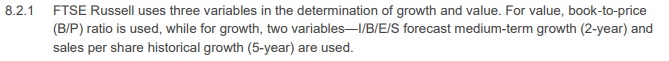

2/ Here is the methodology for what Russell uses to determine what goes into their growth indices (2 year projected growth and historical 5 year sales).

3/ One thing to note is this index ISN& #39;T "not value". This means that it doesn& #39;t own the most expensive half of stocks, it tries to own companies that are growing.

This means that, in and of itself, there shouldn& #39;t be a negative expected return from this by being short value.

This means that, in and of itself, there shouldn& #39;t be a negative expected return from this by being short value.

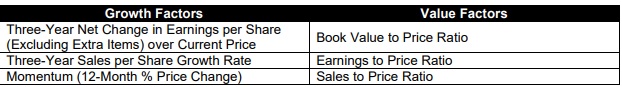

5/ One thing to note here is that S&P explicitly uses MOMENTUM in constructing their growth indices!

Also, S&P also isn& #39;t "not value".

Also, S&P also isn& #39;t "not value".

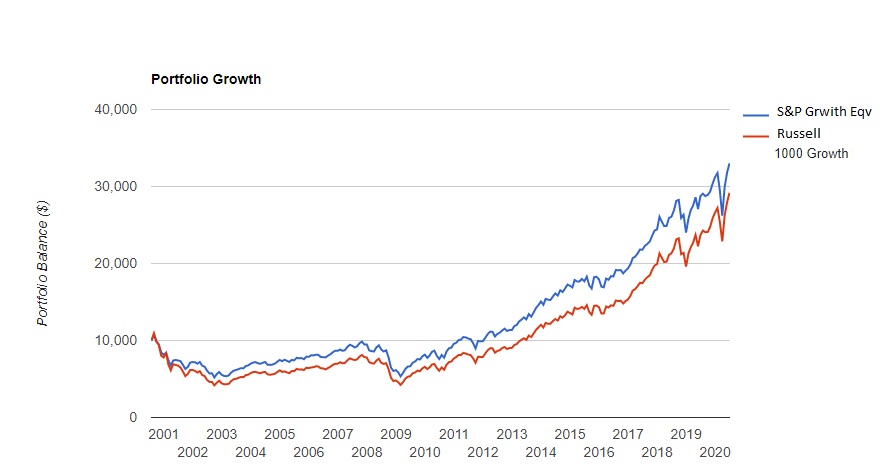

6/ Does this difference in index methodology matter in returns? Let& #39;s take a look:

(I use 85% S&P 500 index and 15% S&P 400 index for S&P so that it nullifies the market cap difference between the Russell 1000 index).

(I use 85% S&P 500 index and 15% S&P 400 index for S&P so that it nullifies the market cap difference between the Russell 1000 index).

8/ So what is going on here? The performance difference is arising from the index construction methodology, ie, S&P is effectively long price momentum (known return factor) vs. Russell that uses only fundamental growth data (S&P uses it too so there is some differences there).

Fin/ This means that one can effectively implement academic factors even using index data. For example, if you want to include momentum in your portfolio, you might want to choose S&P indices vs. Russell. These choices can lead to different index performance!

Read on Twitter

Read on Twitter