Microcap investors are mainly retail investors. Some of the best microcap investors I know are small business owners. They understand the complexity, volatility, and nuances of running a small business. Microcap isn’t an institutional asset class, it’s an entrepreneurial one.

Most "financial professionals" think you& #39;re dumb for investing in these small companies, but that is only because they can only buy them after they go up 10x, are 70% institutional held, and have 10 analysts covering them.

The financial machine loves lemmings.

The financial machine loves lemmings.

The haters will say microcaps are sleazy slimy uninvestable companies. Yes, plenty of those. But a lot less than VC. The nice thing is most file audited financials with the SEC, and if you know how to read financial statements you can cut out a lot of the risk.

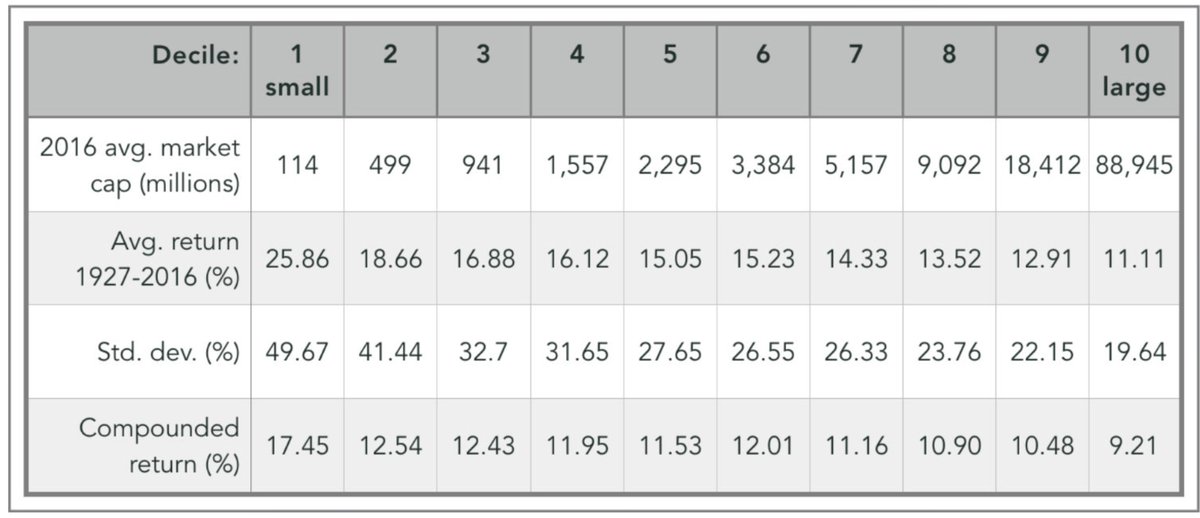

From 1927 – 2016, the smallest decile of the public market (<$114 million market cap) has outperformed all other market cap classes.

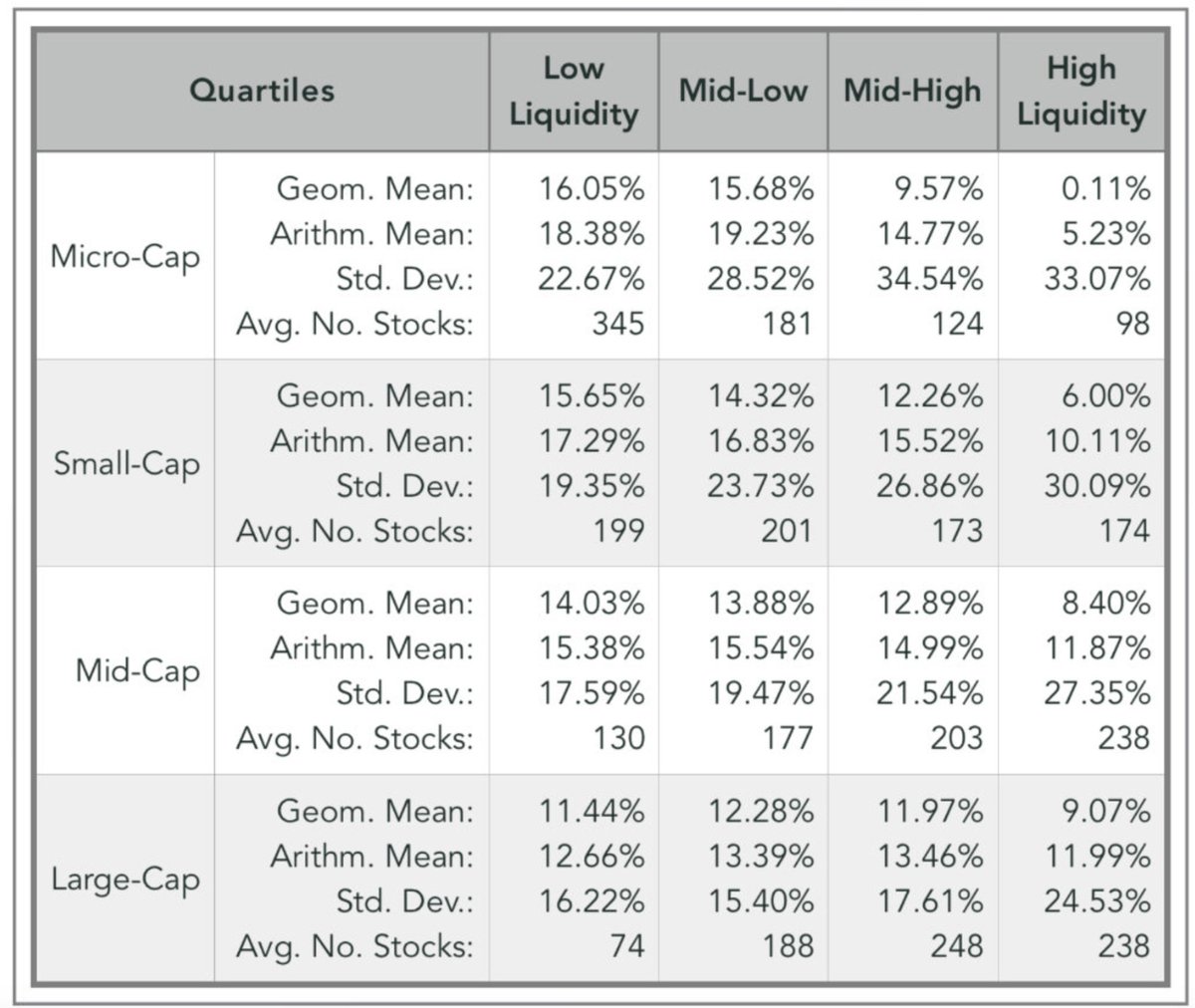

Roger Ibbotson concluded that liquidity dominates size as a return predictor and provides evidence illustrated in the table below. Illiquid microcaps since 1971..

Buffett, Lynch, Greenblatt, they all started in microcap for a reason. It& #39;s the only place in the public markets where an astute investor managing a small sum has a structural advantage over institutions.

It is where greatness starts.

Goodnight.

It is where greatness starts.

Goodnight.

Read on Twitter

Read on Twitter