A thread on #ITC

<1> First the Beautiful Part of the company. Strong Balance Sheet, Cash Flows and Return Ratios. Everything enviable.

<1> First the Beautiful Part of the company. Strong Balance Sheet, Cash Flows and Return Ratios. Everything enviable.

<2> The company& #39;s capex has been relatively conservative and assets have not been sweating enough as suggested by stagnating Sales to Gross Block.

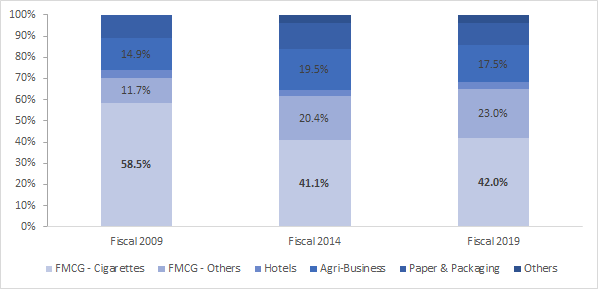

<3> Though the company has been looking to diversify away from Cigarettes business, it continues to form 42% of its overall revenue #ITC

<4> Deep-diving further now and perhaps data which cause more unease. Cigarettes continues to form about 85% of the company& #39;s total profit. #ITC is still very much a & #39;Cigarettes& #39; company

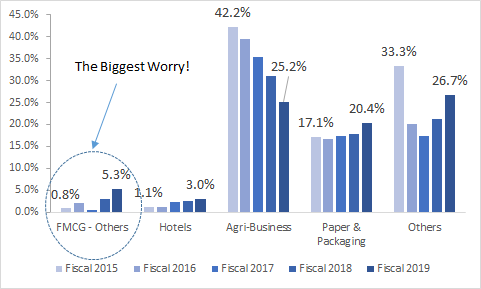

<5>The margins from its branded FMCG segment (under & #39;FMCG - Others& #39;) was merely 2.6% as of fiscal 2019. Yes, many of its products are at an early stage of its product lifecycle, but the same does not ensure that all products will witness margins expansion over long-run #ITC

<6> Yes, the company has made substantial capex investments over the last five years in-order to diversify away from Cigarettes business. But, have they yielded fruits? #ITC

<7> Despite the investment in Branded FMCG segment (contributing 23% to its revenue), the ROCE is currently languishing at low-single digits as illustrated below. The ROCE for hotels segment as well will drop for fiscal 2021 due to #Covid_19 #ITC

Read on Twitter

Read on Twitter