Earlier this week I released a report on @compoundfinance

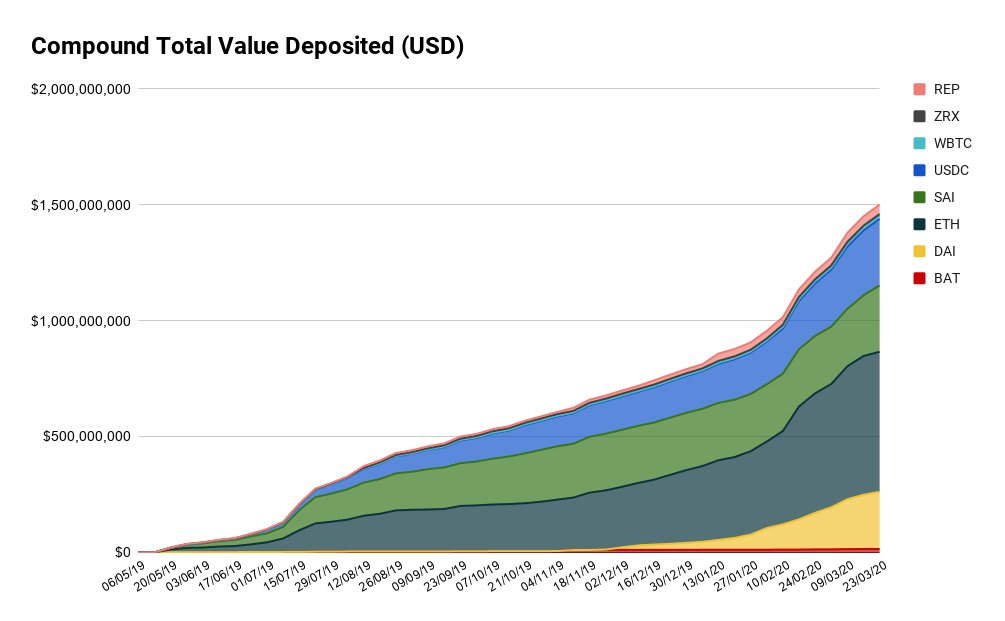

The #DeFi lending protocol has seen substantial growth, reaching $1.5B in total supply + $300M in borrowing activity since inception

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index"> Full report live on @DefiRate

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index"> Full report live on @DefiRate  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">

1/ https://defirate.com/compound-research/">https://defirate.com/compound-...

The #DeFi lending protocol has seen substantial growth, reaching $1.5B in total supply + $300M in borrowing activity since inception

1/ https://defirate.com/compound-research/">https://defirate.com/compound-...

2/ Despite offering <0.1% interest rates, ETH leads in cumulative deposits with $604M supplied to the lending protocol https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Exploding head" aria-label="Emoji: Exploding head">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Exploding head" aria-label="Emoji: Exploding head">

Next up is @MakerDAO& #39;s Dai/Sai which totaled $532M

USDC - $287M

The remaining assets combined for <5% of total deposits

Next up is @MakerDAO& #39;s Dai/Sai which totaled $532M

USDC - $287M

The remaining assets combined for <5% of total deposits

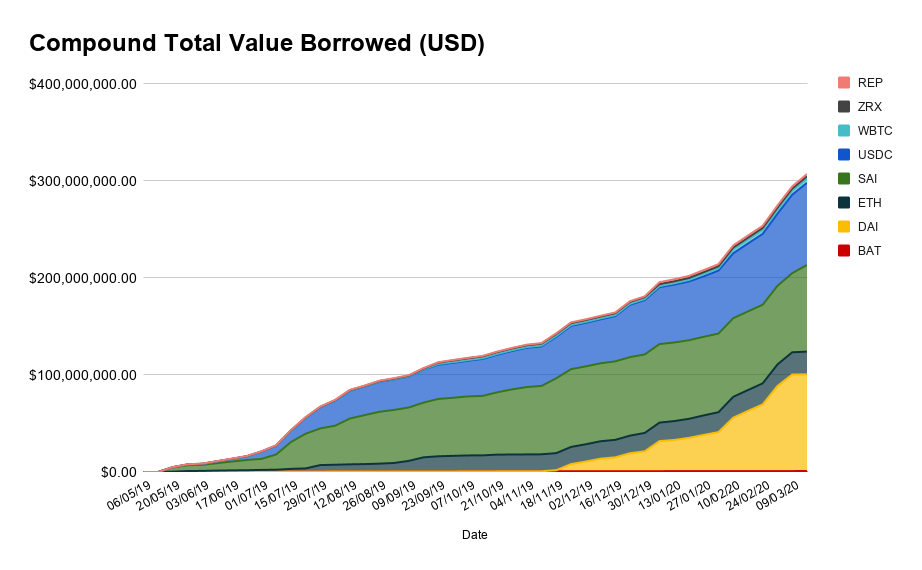

The large majority of total borrowing activity comes from stablecoins

Of the $306M in cumulative borrows, $188M of it derives from $DAI or $SAI

The other significant borrowing activity naturally comes from the other stablecoin - $USDC - with nearly $85M in lending activity

Of the $306M in cumulative borrows, $188M of it derives from $DAI or $SAI

The other significant borrowing activity naturally comes from the other stablecoin - $USDC - with nearly $85M in lending activity

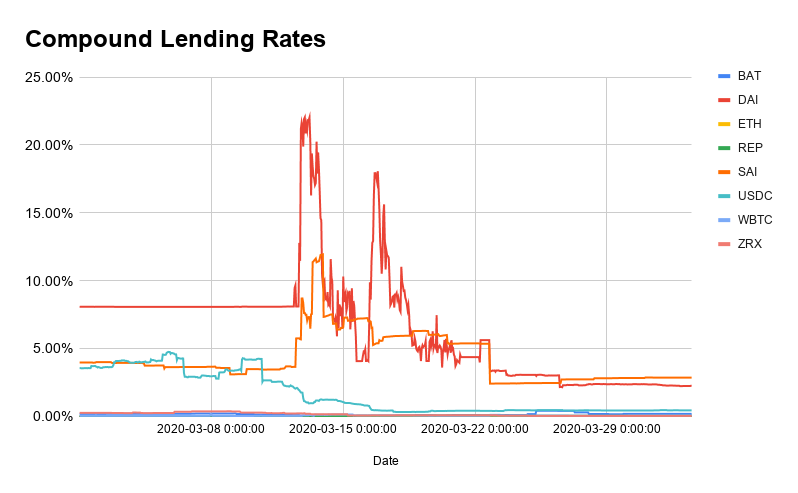

Since Black Thursday earlier this month, where lending rates experienced significant volatility (peaking at 20% APY), yields have taken a hard hit

As it stands today:

DAI: 0.36%

USDC: 0.41%

For reference - Dai rates started off the month hovering around ~8% https://abs.twimg.com/emoji/v2/... draggable="false" alt="😨" title="Fearful face" aria-label="Emoji: Fearful face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😨" title="Fearful face" aria-label="Emoji: Fearful face">

As it stands today:

DAI: 0.36%

USDC: 0.41%

For reference - Dai rates started off the month hovering around ~8%

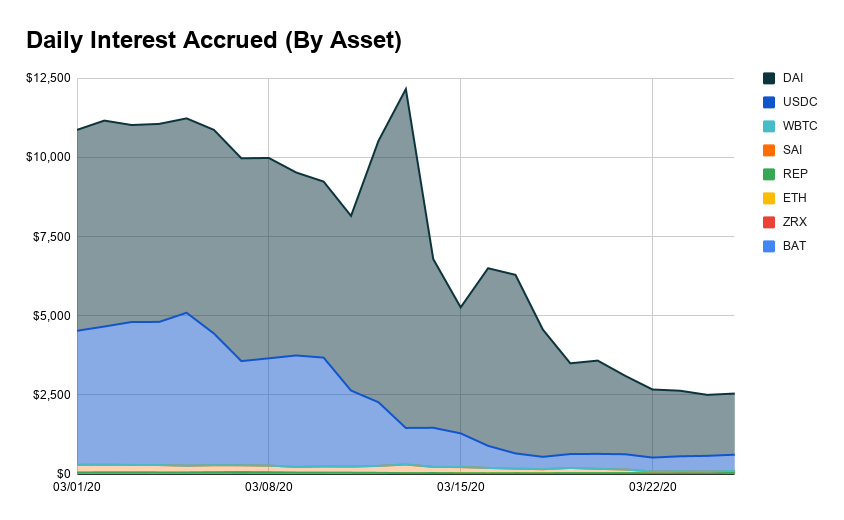

This trend is further emphasized when looking at daily interest accrued by asset

Despite the downturn in yields, DAI still accounts for 68% of the interest accrued this month

Comparatively, USDC accounts for 28%

The rest of the assets combine for <4% of interest accrued

Despite the downturn in yields, DAI still accounts for 68% of the interest accrued this month

Comparatively, USDC accounts for 28%

The rest of the assets combine for <4% of interest accrued

This #DeFi report expands on my contribution to "Our Network" a few weeks ago

Make sure to subscribe to that newsletter for weekly insights on major networks and protocols from leading analysts in the space https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Fire" aria-label="Emoji: Fire">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Fire" aria-label="Emoji: Fire">

https://ournetwork.substack.com/

cc">https://ournetwork.substack.com/">... @spencernoon

fin

Make sure to subscribe to that newsletter for weekly insights on major networks and protocols from leading analysts in the space

https://ournetwork.substack.com/

cc">https://ournetwork.substack.com/">... @spencernoon

fin

Read on Twitter

Read on Twitter Next up is @MakerDAO& #39;s Dai/Sai which totaled $532MUSDC - $287M The remaining assets combined for <5% of total deposits" title="2/ Despite offering <0.1% interest rates, ETH leads in cumulative deposits with $604M supplied to the lending protocolhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Exploding head" aria-label="Emoji: Exploding head">Next up is @MakerDAO& #39;s Dai/Sai which totaled $532MUSDC - $287M The remaining assets combined for <5% of total deposits" class="img-responsive" style="max-width:100%;"/>

Next up is @MakerDAO& #39;s Dai/Sai which totaled $532MUSDC - $287M The remaining assets combined for <5% of total deposits" title="2/ Despite offering <0.1% interest rates, ETH leads in cumulative deposits with $604M supplied to the lending protocolhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Exploding head" aria-label="Emoji: Exploding head">Next up is @MakerDAO& #39;s Dai/Sai which totaled $532MUSDC - $287M The remaining assets combined for <5% of total deposits" class="img-responsive" style="max-width:100%;"/>

" title="Since Black Thursday earlier this month, where lending rates experienced significant volatility (peaking at 20% APY), yields have taken a hard hit As it stands today: DAI: 0.36%USDC: 0.41% For reference - Dai rates started off the month hovering around ~8%https://abs.twimg.com/emoji/v2/... draggable="false" alt="😨" title="Fearful face" aria-label="Emoji: Fearful face">" class="img-responsive" style="max-width:100%;"/>

" title="Since Black Thursday earlier this month, where lending rates experienced significant volatility (peaking at 20% APY), yields have taken a hard hit As it stands today: DAI: 0.36%USDC: 0.41% For reference - Dai rates started off the month hovering around ~8%https://abs.twimg.com/emoji/v2/... draggable="false" alt="😨" title="Fearful face" aria-label="Emoji: Fearful face">" class="img-responsive" style="max-width:100%;"/>