1/ #COVID19 “upends the wisdom about remittances being very stable” “The countries where migrant workers are temporarily based are experiencing a big crisis, and many of them are in the sectors that are being hit.”

thank you for the quotes @ainefquinn https://www.bloomberg.com/news/articles/2020-04-07/the-money-s-not-coming-home-the-690-billion-remittance-risk?sref=nzbTAqLT">https://www.bloomberg.com/news/arti...

thank you for the quotes @ainefquinn https://www.bloomberg.com/news/articles/2020-04-07/the-money-s-not-coming-home-the-690-billion-remittance-risk?sref=nzbTAqLT">https://www.bloomberg.com/news/arti...

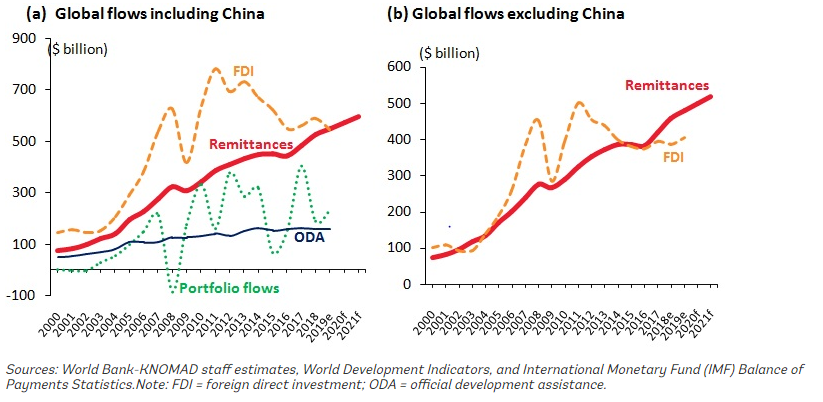

2/ Remittances normally tend to be more stable sources of BoP inflows #EmergingMarkets

Especially important as portfolio flows are volatile and FDI flows recently have dried up

@WorldBank and @IMFNews data.

Especially important as portfolio flows are volatile and FDI flows recently have dried up

@WorldBank and @IMFNews data.

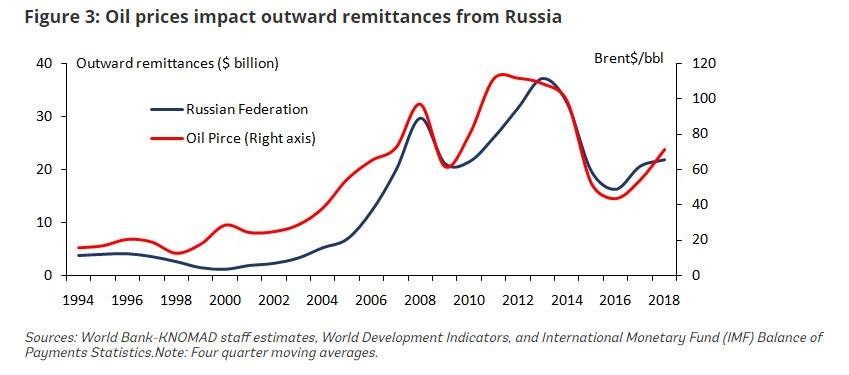

3/ Remittances tend to dry up when oil price falls #OilPriceWar as Russia and MENA oil producers are important sources of remittances globally @WorldBank

Close relationship between outwards remittances and oil price

Close relationship between outwards remittances and oil price

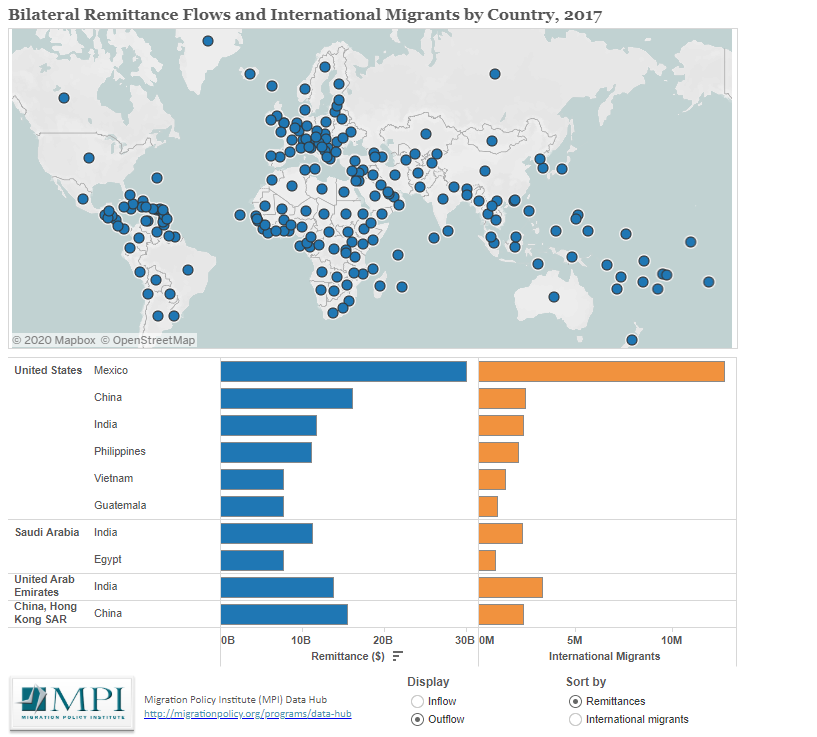

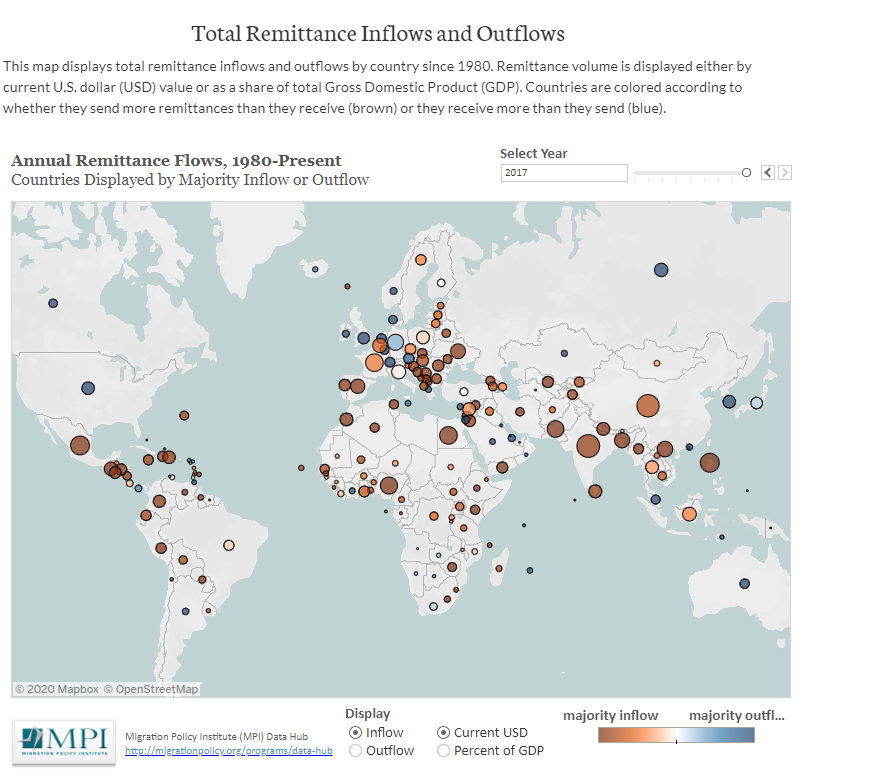

4/ Remittances crucially depend on the host country economic performance. US, MENA, Europe are key sources of remittance outflows.

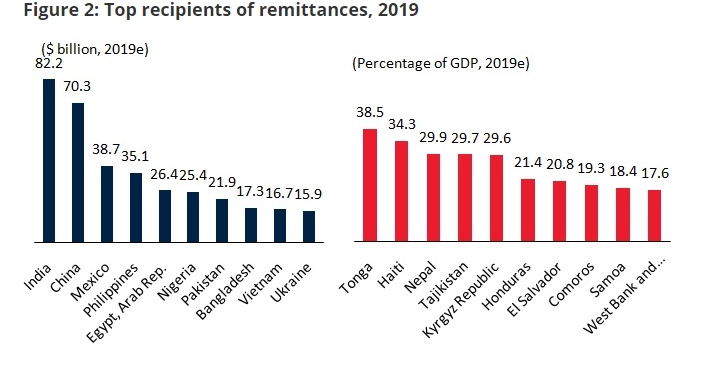

5/ Remittances are particularly important for emerging and frontier markets @WorldBank

6/ Great visuals here on inflows and outflows of remittances by @MigrationPolicy using and complimenting @WorldBank data

Read on Twitter

Read on Twitter