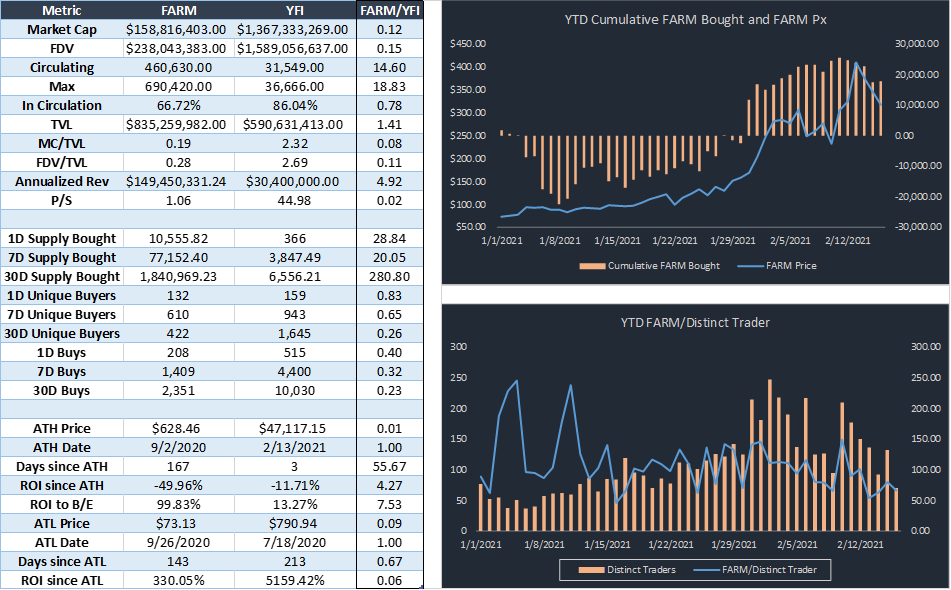

One of my high-level investing theses lately has been investing in cash-flow accruing protocols that aggresively scale through new product integrations (why I am invested in HEGIC and SUSHI) that trade at a discount relative to their peers. This has led me to buy FARM recently.

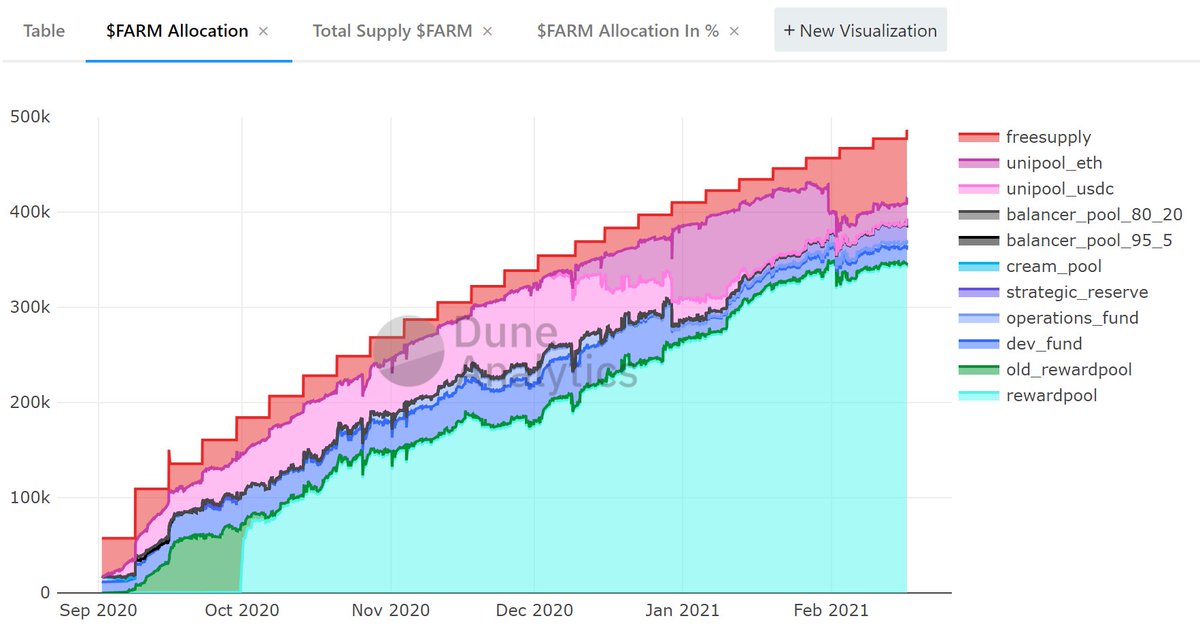

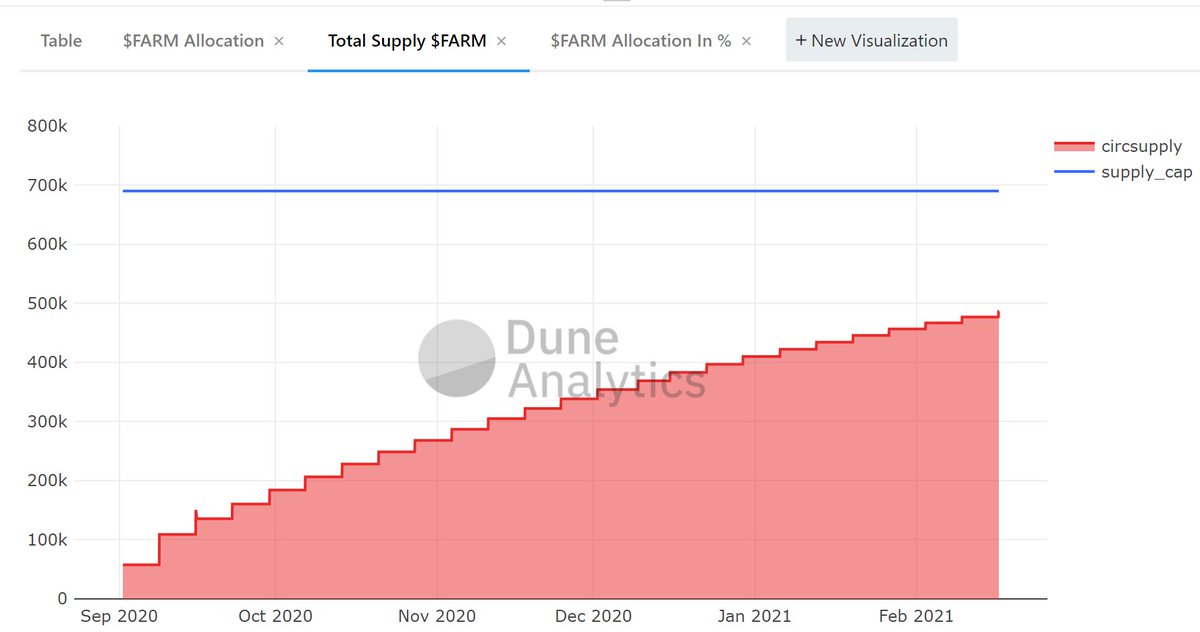

From a supply perspective, FARM has a max supply of 690,420 with decreasing weekly emissions. Emission allocation is 70% to LPs, 20% to the FARM team, and 10% to the FARM treasury).

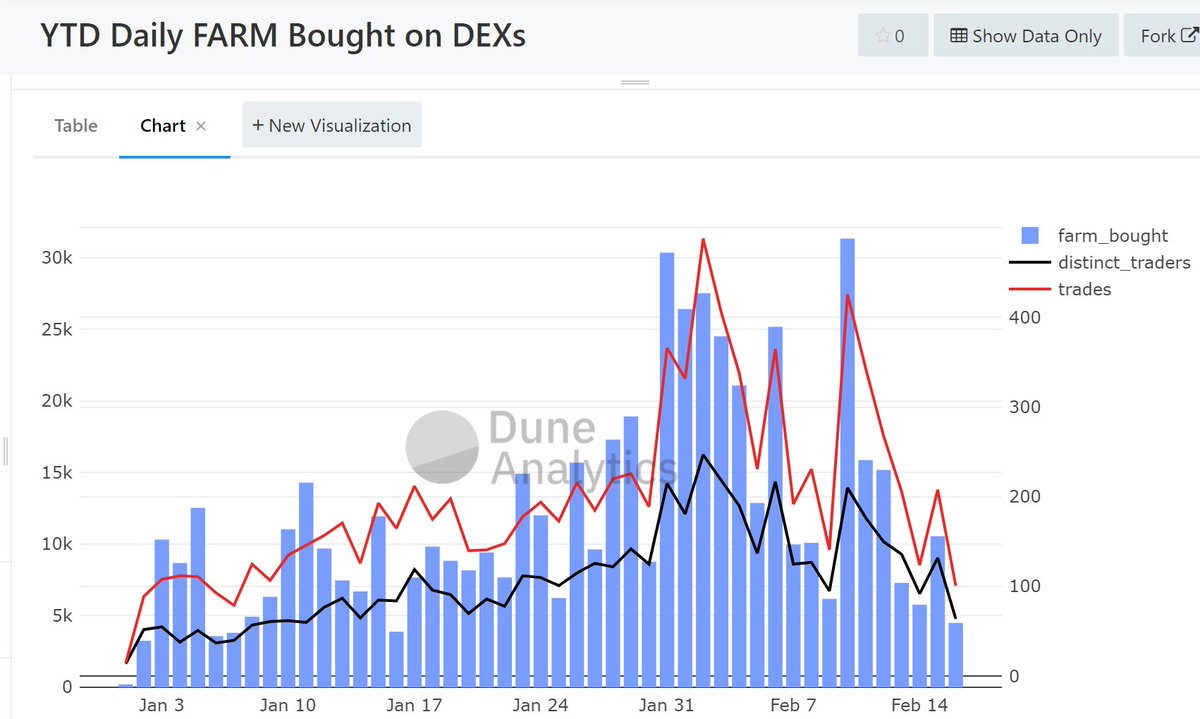

H/T @0xBoxer for the awesome Dune graphs

H/T @0xBoxer for the awesome Dune graphs

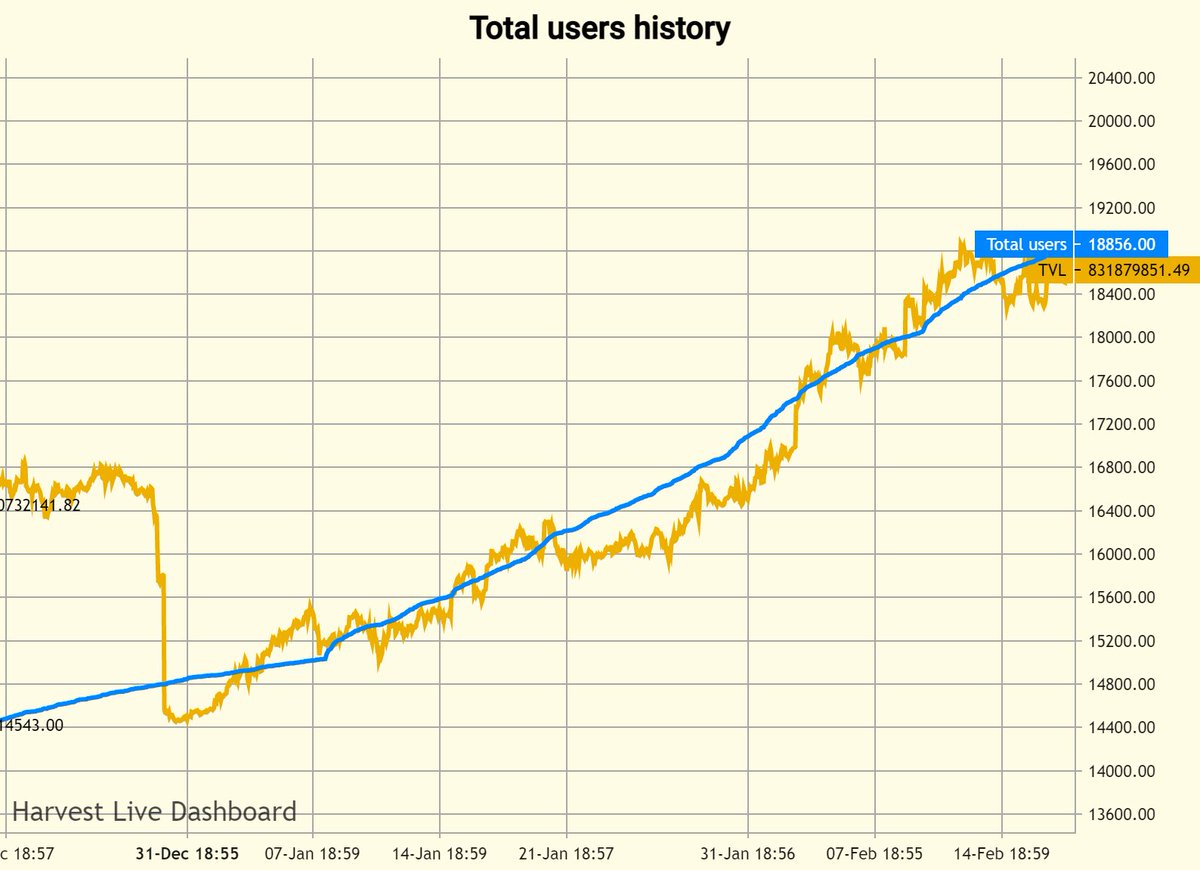

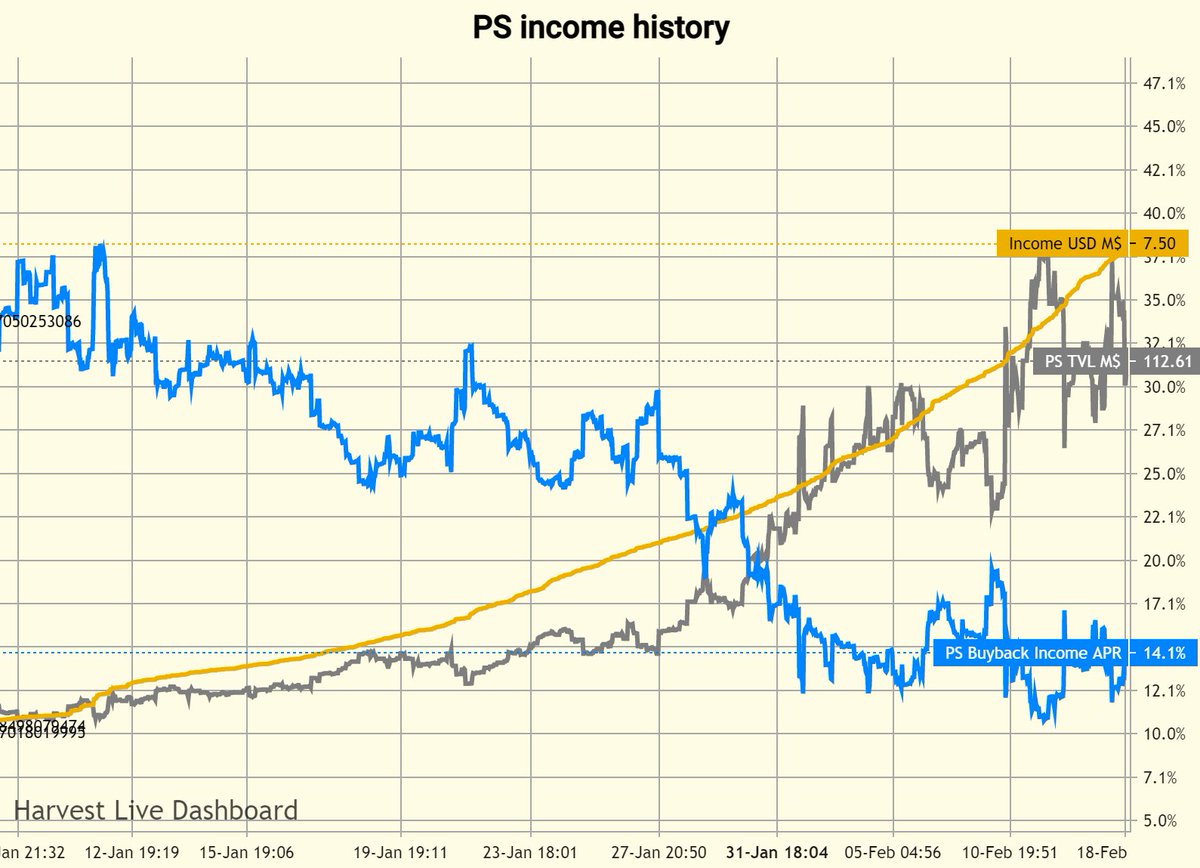

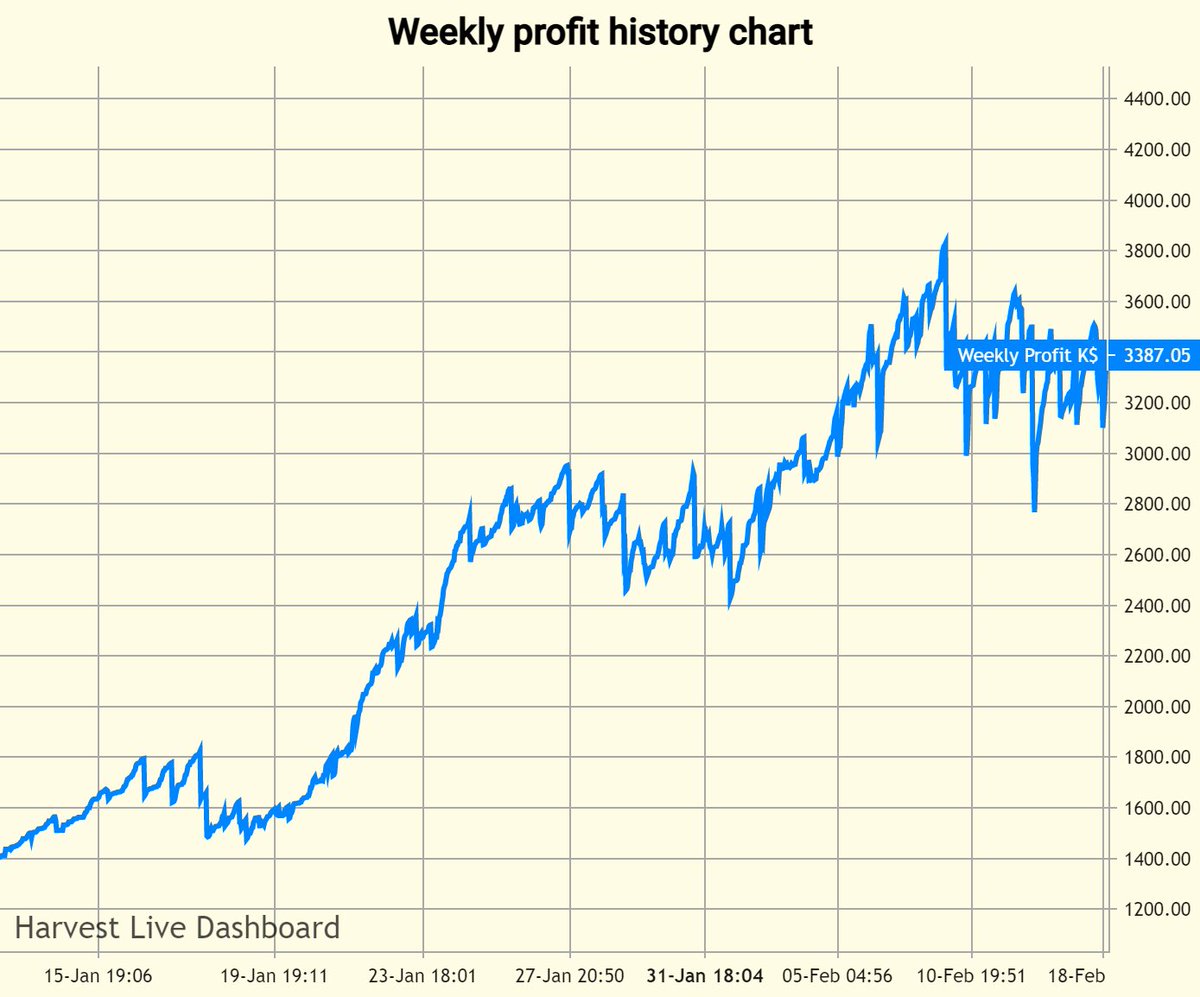

Harvest has been a TVL/revenue generating machine with a clear PMF regarding being a cost efficient platform for automated yield farming.

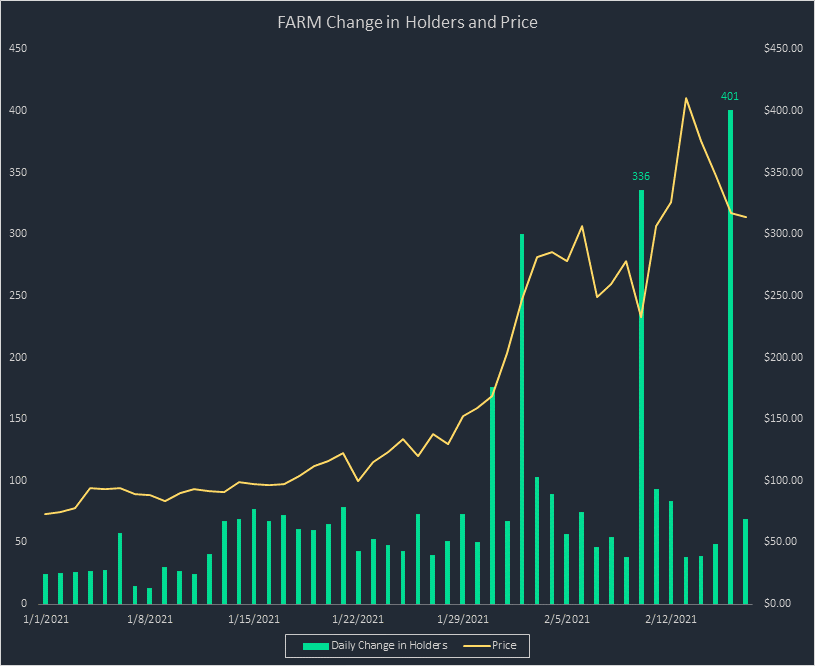

With the uptick in holders/users as well as daily FARM bought/quantity of unique wallets buying/buy trades on DEXs, it appears that people are paying more attention to dips, as the two largest changes in holders came on days the FARM price was dropping.

Read on Twitter

Read on Twitter