A brief thread about where game theory predicts the price of $GME might go: Regardless of what you think about the move in Gamestop stock, at some point people will sell their shares and the stock will crater back to Earth, right? Let's investigate! 1/6

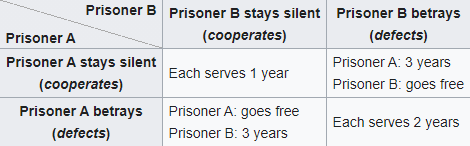

@nope_its_lily pointed out that you could think about this as a prisoner's dilemma, in which 2 players can choose to cooperate or defect. The dominant strategy says both players defect, even though they will be worse off than if they both cooperate. 2/6

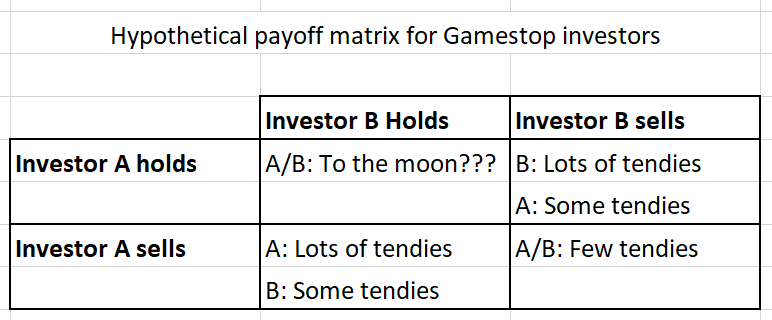

Applied to our GameStop situation, the question becomes whether to hold (cooperate) or sell (defect). While it might seem like game theory and common sense say investors should sell $GME, it's not quite that simple. 3/6

For one, we don't know what the payoffs are. The canonical prisoner's dilemma says the worst outcome is if YOU are left holding the bag, but holding $GME a little longer may yield a bigger payoff. 4/6

More importantly, the standard prisoner's dilemma is non-repeated: you only get one shot. When the game is iterated, players can signal to each other and build up trust. Indeed, Robert Aumann showed that players can cooperate indefinitely (and won a Nobel Prize for it). 5/6

So, where does this leave us? Experiments show that people do often cooperate, but today's 30% decline would strike fear in all but the strongest

diamond hands. Plus the reality is that hedge funds are driving $GME movement. Only time will tell, but I am here for it. 6/6

diamond hands. Plus the reality is that hedge funds are driving $GME movement. Only time will tell, but I am here for it. 6/6

diamond hands. Plus the reality is that hedge funds are driving $GME movement. Only time will tell, but I am here for it. 6/6

diamond hands. Plus the reality is that hedge funds are driving $GME movement. Only time will tell, but I am here for it. 6/6

Read on Twitter

Read on Twitter