I don't know much about Miami or Austin, but I am 100% sure that the Seattle/PNW startup market is seriously underrated and underreported.

My favorite example of this last year was @ZoomInfo's $935M IPO (at a $13B valuation).

TechCrunch's first writeup on this massive IPO was, "The ZoomInfo IPO slipped through our fingers in the last news cycle, so we’re going to catch up."

TechCrunch's first writeup on this massive IPO was, "The ZoomInfo IPO slipped through our fingers in the last news cycle, so we’re going to catch up."

In case you want to get caught up on what's happening in the PNW startup market, too, here are a few slides on what's going on up here:

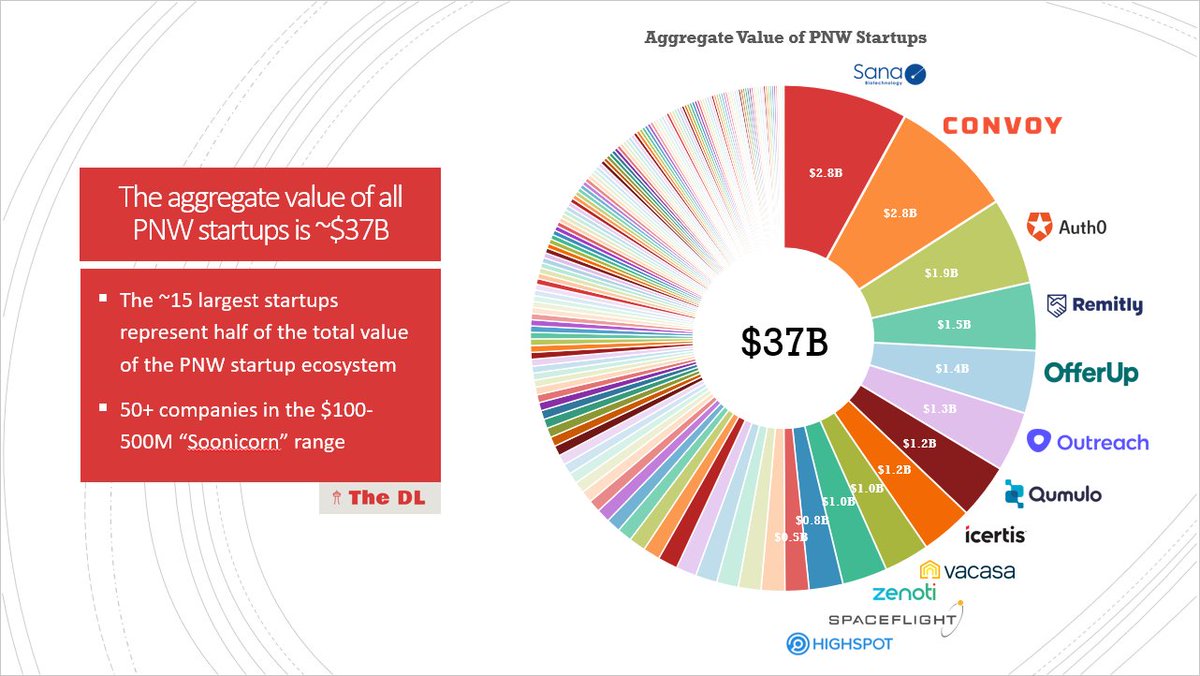

~$37B of private company value, with a good distribution across different stages and sectors

~$37B of private company value, with a good distribution across different stages and sectors- 10+ $1B companies

- 50+ $100M companies

- Lots of B2B, lots of B2C, lots of life sciences

Huge increase in the number of unicorns minted each year over the last 5 years

Huge increase in the number of unicorns minted each year over the last 5 years- From 1-2 per year in the first half of the decade to 4-5+ per year over the last few years

- You don't get this kind of growth overnight. These companies were all started 5-10 years ago

A lot of other stuff going on up here, too! If you want to check out the full deck, here's a link: http://bit.ly/3odMA2J

A lot of other stuff going on up here, too! If you want to check out the full deck, here's a link: http://bit.ly/3odMA2J And check out my weekly newsletter if you want to stay up to date: http://bit.ly/394lJ4E

Read on Twitter

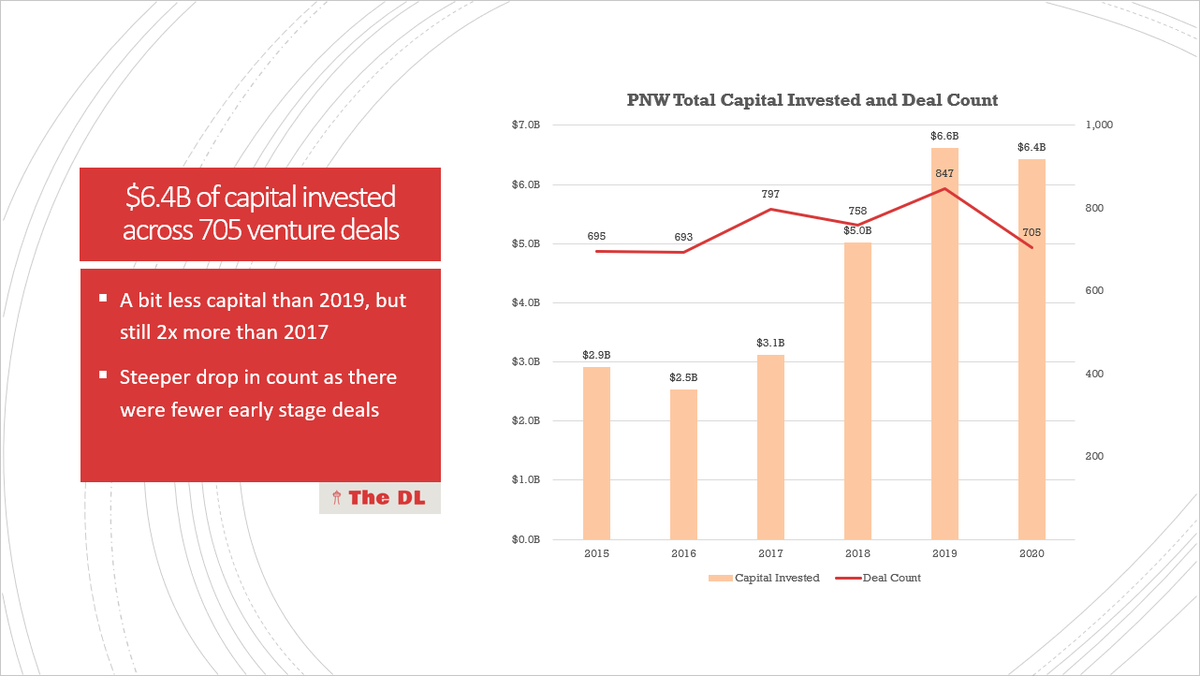

Read on Twitter $6.4B of capital invested across 705 deals in the PNW in 2020

$6.4B of capital invested across 705 deals in the PNW in 2020