Last week, the ECB started to publish the breakdown of Minimum Reserve Requirements for banks (MRR), which was lacking in the Eurosystem balance sheet.

It matters because we can now compute the exact ‘cost’ of negative policy rates for each country. (1/n) https://www.ecb.europa.eu/mopo/two-tier/html/two-tier_qa.en.html

It matters because we can now compute the exact ‘cost’ of negative policy rates for each country. (1/n) https://www.ecb.europa.eu/mopo/two-tier/html/two-tier_qa.en.html

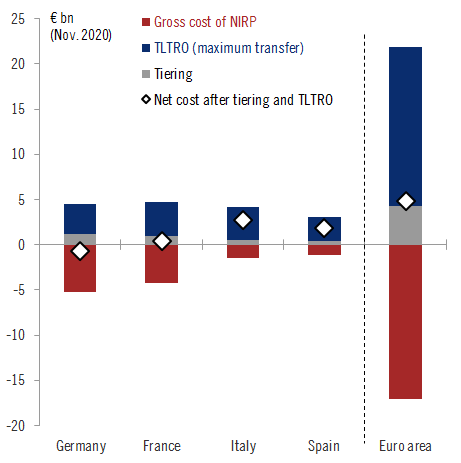

The latest data from late 2020 shows how much the annual gross cost of NIRP for banks (-€17bn) has been reduced by deposit tiering since November 2019 (+€3bn) and dual rates TLTRO since March 2020 (+€18bn).

The result is a €5bn net *transfer* to the banking sector. (2/n)

The result is a €5bn net *transfer* to the banking sector. (2/n)

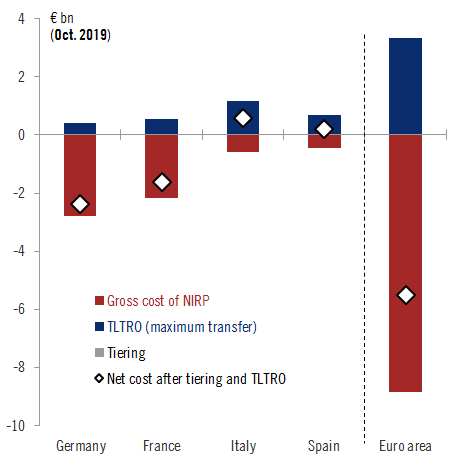

The situation has changed dramatically since October 2019, just before tiering was introduced. At that time, NIRP still had a large net negative effect as TLTRO only compensated for one third of the gross cost. (3/n)

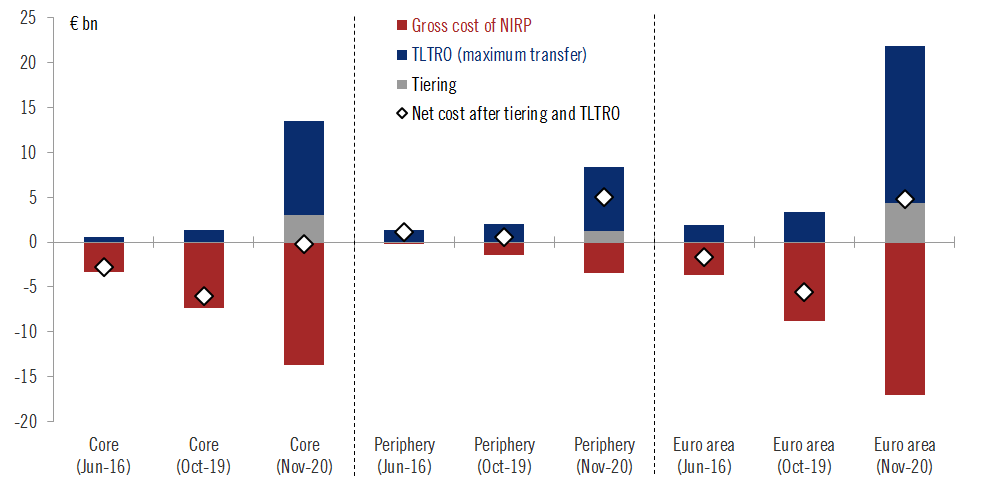

This chart shows how tiering and TLTRO have shifted the cost of NIRP for banks in the core and the periphery.

The effect has been broad-based, fully mitigating NIRP negatives for the core while engineering a (quasi-fiscal) transfer to the periphery. (4/n)

The effect has been broad-based, fully mitigating NIRP negatives for the core while engineering a (quasi-fiscal) transfer to the periphery. (4/n)

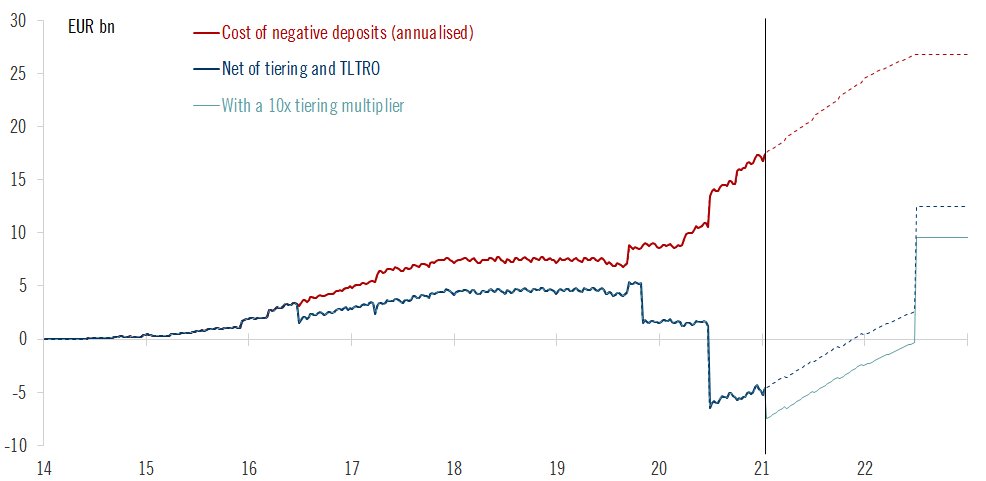

What next? Although the TLTRO discount period was extended until June 2022, the net 'cost' of NIRP will turn positive again by early 2022, rising to over €10bn in H2 2022. An increase in the tiering multiplier, from 6x to 10x, would only reduce this cost by €3bn. (5/n)

Meanwhile, the ECB may contemplate a further easing to TLTRO terms, depending on how bank lending conditions change over time. (6/6)

Read on Twitter

Read on Twitter