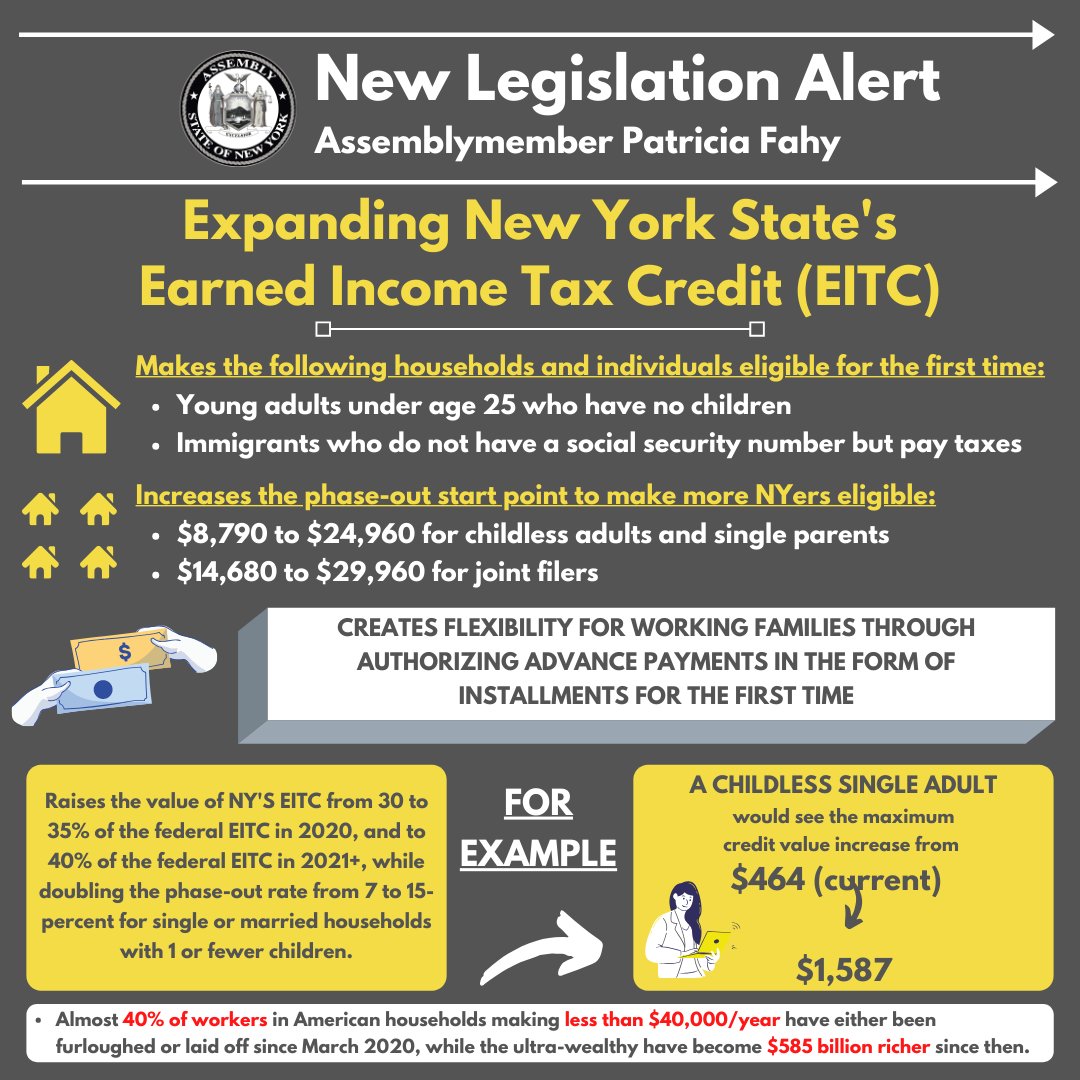

Today, I introduced legislation to significantly transform and increase New York’s Earned Income Tax Credit (EITC) by:

Today, I introduced legislation to significantly transform and increase New York’s Earned Income Tax Credit (EITC) by: Increasing state credit's value from 30 to 40% of the federal credit

Increasing state credit's value from 30 to 40% of the federal credit Makes young adult (18-25 yr. olds) and immigrant workers eligible

Makes young adult (18-25 yr. olds) and immigrant workers eligible 1/4

1/4

Creating flexibility in payments by newly authorizing quarterly payments

Creating flexibility in payments by newly authorizing quarterly paymentsFor the first time, all income-eligible workers, including those 18-25 who have no children, and those who do not have a social security number but pay taxes, would be eligible.

2/4

Income #inequality is one of the most pressing issues of our time — and getting worse — the wealth gap between the richest and poorer families has more than doubled since 1989, according to the @pewresearch. https://www.pewsocialtrends.org/2020/01/09/trends-in-income-and-wealth-inequality/

Income #inequality is one of the most pressing issues of our time — and getting worse — the wealth gap between the richest and poorer families has more than doubled since 1989, according to the @pewresearch. https://www.pewsocialtrends.org/2020/01/09/trends-in-income-and-wealth-inequality/3/4

Working families need real, tangible support — expanding NY's #EITC is a critical part of ensuring the economy recovers from the 'bottom-up' rather than 'top-down'. Read more  https://tinyurl.com/expandingEITC

https://tinyurl.com/expandingEITC

4/4

https://tinyurl.com/expandingEITC

https://tinyurl.com/expandingEITC 4/4

Read on Twitter

Read on Twitter