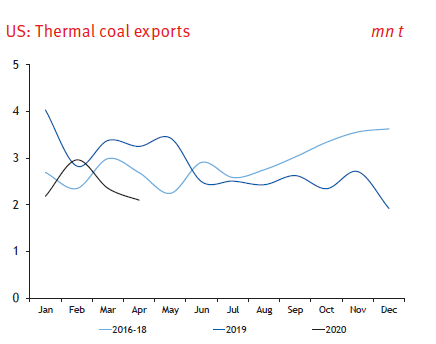

New data for #coal exports by @ArgusMedia shows grim outlook for thermal coal in 2020, with #COVID19 causing declines in global coal exports of 2.7mn t in March and 3mn t in April, while prices have slumped to historical lows

Unroll for forecasts for biggest coal exporters

Unroll for forecasts for biggest coal exporters

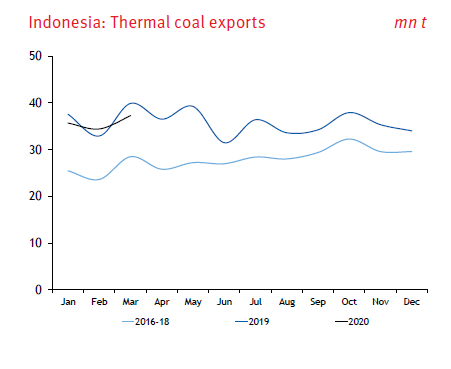

Indonesian  exports declined nearly 3mn t in the first quarter and will probably be hit hard in the rest of the year by lower power-sector demand in India

exports declined nearly 3mn t in the first quarter and will probably be hit hard in the rest of the year by lower power-sector demand in India  squeezing further coal producers’ profit margins

squeezing further coal producers’ profit margins

exports declined nearly 3mn t in the first quarter and will probably be hit hard in the rest of the year by lower power-sector demand in India

exports declined nearly 3mn t in the first quarter and will probably be hit hard in the rest of the year by lower power-sector demand in India  squeezing further coal producers’ profit margins

squeezing further coal producers’ profit margins

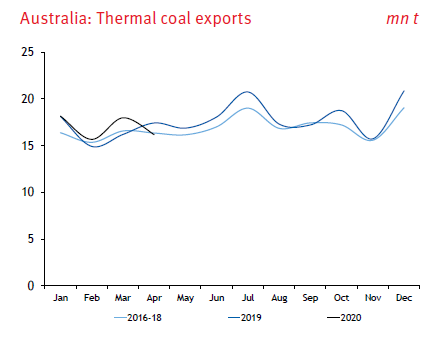

Australian  coal was in loss-making territory at many mines in May following the price slump and a threatened import ban by major buyer China

coal was in loss-making territory at many mines in May following the price slump and a threatened import ban by major buyer China  , as relations deteriorate between the two

, as relations deteriorate between the two

coal was in loss-making territory at many mines in May following the price slump and a threatened import ban by major buyer China

coal was in loss-making territory at many mines in May following the price slump and a threatened import ban by major buyer China  , as relations deteriorate between the two

, as relations deteriorate between the two

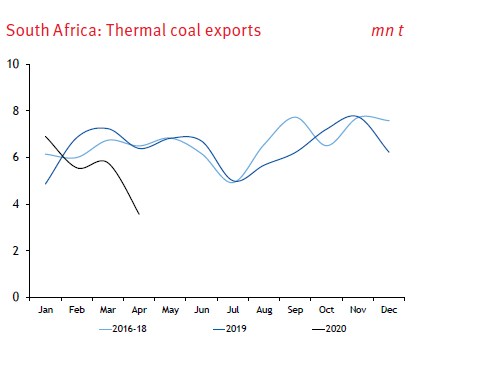

South African  exports have fallen sharply because of the plunge in coal demand in India

exports have fallen sharply because of the plunge in coal demand in India  forcing ZAF to

forcing ZAF to

diversify and expand sales into other markets, but at the expense of lower prices

exports have fallen sharply because of the plunge in coal demand in India

exports have fallen sharply because of the plunge in coal demand in India  forcing ZAF to

forcing ZAF todiversify and expand sales into other markets, but at the expense of lower prices

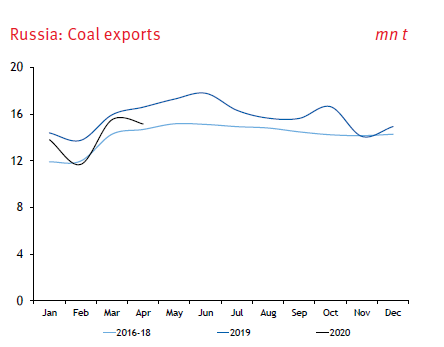

Russian  export volumes were hit hardest in the first quarter, due to low demand in South Korea

export volumes were hit hardest in the first quarter, due to low demand in South Korea  and the EU

and the EU  . For the rest of the year, the potential stricter restrictions on Chinese imports is a downside risk

. For the rest of the year, the potential stricter restrictions on Chinese imports is a downside risk

export volumes were hit hardest in the first quarter, due to low demand in South Korea

export volumes were hit hardest in the first quarter, due to low demand in South Korea  and the EU

and the EU  . For the rest of the year, the potential stricter restrictions on Chinese imports is a downside risk

. For the rest of the year, the potential stricter restrictions on Chinese imports is a downside risk

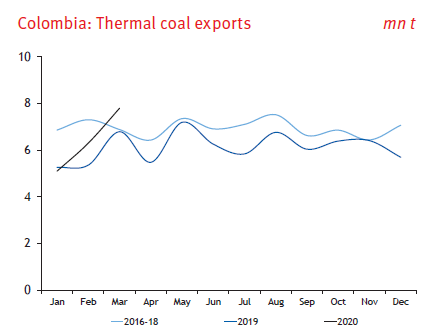

The pandemic has exacerbated the decline in Colombian  exports by the collapse in the Atlantic market. Margins for many producers are likely to be negative

exports by the collapse in the Atlantic market. Margins for many producers are likely to be negative

at current prices, creating a potential headwind to supply

for the rest of the year

exports by the collapse in the Atlantic market. Margins for many producers are likely to be negative

exports by the collapse in the Atlantic market. Margins for many producers are likely to be negativeat current prices, creating a potential headwind to supply

for the rest of the year

Read on Twitter

Read on Twitter

exports have been in steady decline for more than a year and will continue falling due to demand reductions and restrictions in the EU

exports have been in steady decline for more than a year and will continue falling due to demand reductions and restrictions in the EU